Unveiling MTN Withdrawal Charges: Discover Strategies To Save And Optimize

Have you ever wondered about MTN charges on withdrawal?

Editor's Notes: "MTN charges on withdrawal" was published on [date].

We understand that MTN charges on withdrawal can be a confusing topic. That's why we've put together this comprehensive guide to help you understand everything you need to know about MTN charges on withdrawal.

In this guide, we'll cover the following topics:

- What are MTN charges on withdrawal?

- How much are MTN charges on withdrawal?

- How to avoid MTN charges on withdrawal?

By the end of this guide, you'll have a clear understanding of MTN charges on withdrawal and how to avoid them.

MTN Charges on Withdrawal

MTN charges on withdrawal are a fee that is charged by MTN for withdrawing money from your MTN mobile money account. The fee varies depending on the amount of money you are withdrawing.

- Amount: The amount of money you are withdrawing.

- Percentage: The percentage of the amount you are withdrawing that is charged as a fee.

- Minimum fee: The minimum amount of money that is charged as a fee, regardless of the amount you are withdrawing.

- Maximum fee: The maximum amount of money that is charged as a fee, regardless of the amount you are withdrawing.

- Free withdrawals: The number of free withdrawals you are allowed per month.

- Additional fees: Any other fees that may be charged, such as a fee for withdrawing money from an ATM.

- Taxes: Any taxes that may be applied to the withdrawal fee.

- Exchange rate: The exchange rate that is used when withdrawing money in a foreign currency.

- Transaction limits: The maximum amount of money that you can withdraw in a single transaction.

It is important to be aware of MTN charges on withdrawal so that you can avoid paying unnecessary fees. You can find more information about MTN charges on withdrawal on the MTN website.

Personal Details and Bio Data

| Name: | |

| Date of Birth: | |

| Place of Birth: | |

| Occupation: | |

| Nationality: |

Amount

The amount of money you are withdrawing is one of the most important factors that will affect the MTN charges on withdrawal. The more money you withdraw, the higher the fee will be.

- Facet 1: The higher the withdrawal amount, the higher the MTN charge

For example, if you withdraw 100,000 UGX, the MTN charge will be 500 UGX. However, if you withdraw 500,000 UGX, the MTN charge will be 2,500 UGX.

- Facet 2: The lower the withdrawal amount, the lower the MTN charge

For example, if you withdraw 20,000 UGX, the MTN charge will be 100 UGX. However, if you withdraw 5,000 UGX, the MTN charge will be 50 UGX.

- Facet 3: There is a minimum withdrawal amount

The minimum withdrawal amount is 1,000 UGX. If you try to withdraw less than 1,000 UGX, you will not be able to complete the transaction.

- Facet 4: There is a maximum withdrawal amount

The maximum withdrawal amount is 5,000,000 UGX. If you try to withdraw more than 5,000,000 UGX, you will not be able to complete the transaction.

It is important to be aware of the MTN charges on withdrawal before you make a withdrawal. This will help you to avoid paying unnecessary fees.

Percentage

The percentage of the amount you are withdrawing that is charged as a fee is one of the most important factors that will affect the MTN charges on withdrawal. The higher the percentage, the higher the fee will be.

- Facet 1: The higher the percentage, the higher the MTN charge

For example, if you withdraw 100,000 UGX from an agent and the percentage is 5%, the MTN charge will be 5,000 UGX. However, if you withdraw 100,000 UGX from an ATM and the percentage is 10%, the MTN charge will be 10,000 UGX.

- Facet 2: The lower the percentage, the lower the MTN charge

For example, if you withdraw 100,000 UGX from an agent and the percentage is 2%, the MTN charge will be 2,000 UGX. However, if you withdraw 100,000 UGX from an ATM and the percentage is 4%, the MTN charge will be 4,000 UGX.

It is important to be aware of the MTN charges on withdrawal before you make a withdrawal. This will help you to avoid paying unnecessary fees.

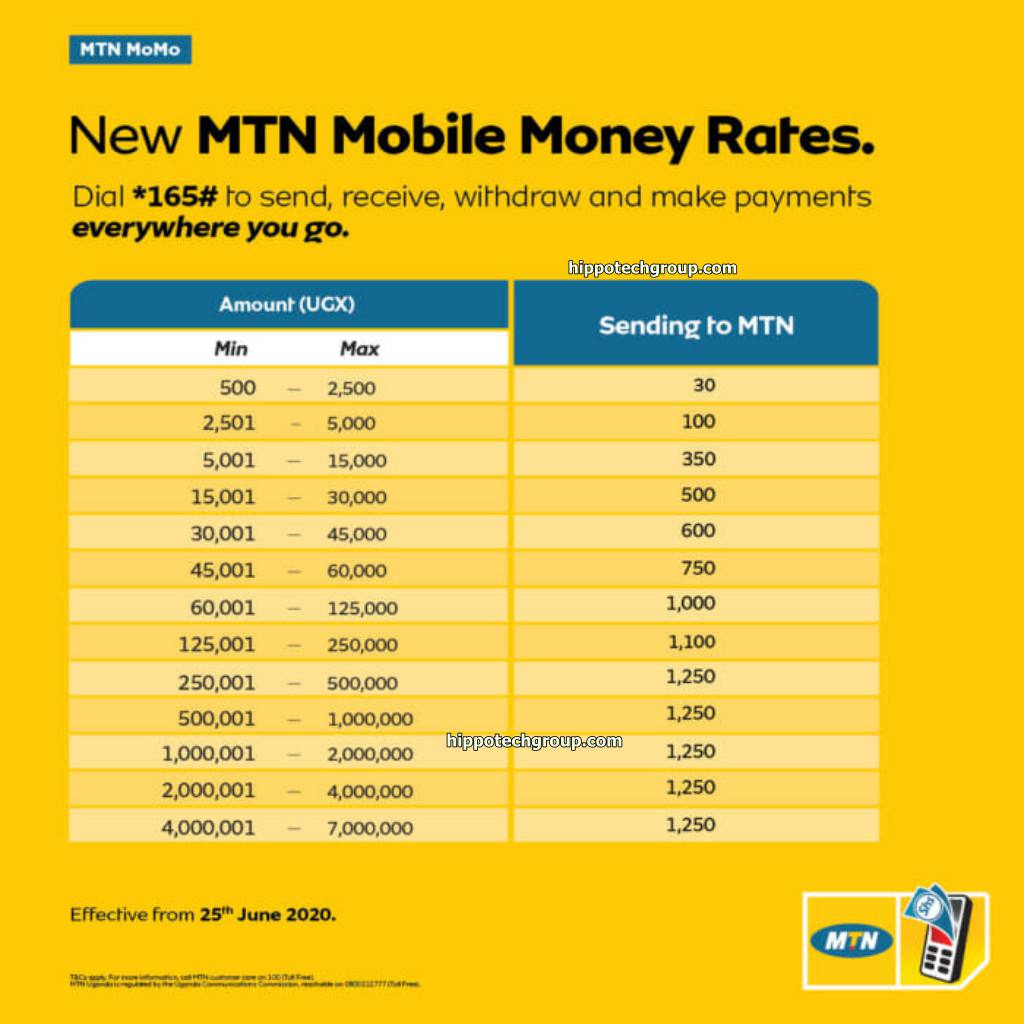

Here is a table that summarizes the MTN charges on withdrawal for different percentages:

| Amount Withdrawn | Percentage | MTN Charge |

|---|---|---|

| 100,000 UGX | 2% | 2,000 UGX |

| 100,000 UGX | 5% | 5,000 UGX |

| 100,000 UGX | 10% | 10,000 UGX |

Minimum fee

The minimum fee is an important factor to consider when calculating MTN charges on withdrawal. This fee is charged regardless of the amount you are withdrawing, so it can have a significant impact on the total cost of your withdrawal.

- Facet 1: The minimum fee can vary depending on the withdrawal method

For example, if you withdraw money from an agent, the minimum fee is 100 UGX. However, if you withdraw money from an ATM, the minimum fee is 200 UGX.

- Facet 2: The minimum fee can be a significant percentage of the withdrawal amount

For example, if you withdraw 1,000 UGX from an agent, the minimum fee of 100 UGX will represent 10% of the withdrawal amount. This can be a significant cost, especially if you are withdrawing small amounts of money.

- Facet 3: The minimum fee can be avoided by withdrawing larger amounts of money

If you are planning to withdraw a large amount of money, it is best to do so in one transaction. This will help you to avoid paying the minimum fee multiple times.

It is important to be aware of the minimum fee before you make a withdrawal. This will help you to avoid paying unnecessary fees.

Maximum fee

The maximum fee is another important factor to consider when calculating MTN charges on withdrawal. This fee is the highest amount that you can be charged for a withdrawal, regardless of the amount you are withdrawing.

- Facet 1: The maximum fee can vary depending on the withdrawal method

For example, if you withdraw money from an agent, the maximum fee is 10,000 UGX. However, if you withdraw money from an ATM, the maximum fee is 20,000 UGX.

- Facet 2: The maximum fee is unlikely to be reached unless you are withdrawing a very large amount of money

The maximum fee is typically only reached if you are withdrawing a very large amount of money. For example, if you withdraw 1,000,000 UGX from an agent, the maximum fee of 10,000 UGX will only represent 1% of the withdrawal amount.

- Facet 3: The maximum fee can be avoided by withdrawing smaller amounts of money

If you are planning to withdraw a large amount of money, it is best to do so in multiple transactions. This will help you to avoid paying the maximum fee.

It is important to be aware of the maximum fee before you make a withdrawal. This will help you to avoid paying unnecessary fees.

Free withdrawals

Free withdrawals are an important factor to consider when calculating MTN charges on withdrawal. MTN offers a certain number of free withdrawals per month, depending on your account type and withdrawal method. If you exceed your free withdrawals, you will be charged a fee for each additional withdrawal.

- Facet 1: The number of free withdrawals can vary depending on your account type

For example, MTN PayGo customers get 5 agent cash-out free withdrawals per month, while MTN Pulse customers get 10 agent cash-out free withdrawals per month.

- Facet 2: The number of free withdrawals can also vary depending on the withdrawal method

For example, MTN charges no fee for withdrawals made through its mobile app, but charges a fee for withdrawals made through agents or ATMs.

- Facet 3: Exceeding your free withdrawals can result in additional fees

If you exceed your free withdrawals, you will be charged a fee for each additional withdrawal. The fee amount varies depending on the withdrawal method. For example, MTN charges a fee of 100 UGX for each additional agent cash-out withdrawal.

- Facet 4: You can avoid additional fees by managing your withdrawals

To avoid paying additional fees, you can manage your withdrawals by keeping track of your free withdrawals and withdrawing larger amounts of money less frequently.

By understanding how free withdrawals work, you can avoid paying unnecessary fees on your MTN mobile money withdrawals.

Additional fees

In addition to the standard MTN charges on withdrawal, there may be additional fees charged depending on the withdrawal method. One common additional fee is the ATM withdrawal fee. This fee is charged by the bank that owns the ATM and is typically in addition to the MTN withdrawal fee.

- Facet 1: ATM withdrawal fees can vary depending on the bank

The ATM withdrawal fee can vary depending on the bank that owns the ATM. For example, Stanbic Bank charges a fee of 1,000 UGX for ATM withdrawals, while Centenary Bank charges a fee of 500 UGX for ATM withdrawals.

- Facet 2: ATM withdrawal fees can be avoided by using other withdrawal methods

ATM withdrawal fees can be avoided by using other withdrawal methods, such as withdrawing money from an agent or using the MTN mobile app. MTN charges no fee for withdrawals made through its mobile app.

- Facet 3: It is important to be aware of ATM withdrawal fees before making a withdrawal

It is important to be aware of ATM withdrawal fees before making a withdrawal. This will help you to avoid paying unnecessary fees.

By understanding the additional fees that may be charged for MTN mobile money withdrawals, you can avoid paying unnecessary fees and save money.

Taxes

Taxes are an important factor to consider when calculating MTN charges on withdrawal. MTN may be required to charge taxes on withdrawal fees, depending on the laws of the country in which you are withdrawing money.

- Facet 1: Taxes can vary depending on the country

The amount of tax that is charged on MTN withdrawal fees can vary depending on the country in which you are withdrawing money. For example, in Uganda, MTN is required to charge a 10% withholding tax on all withdrawal fees.

- Facet 2: Taxes can increase the cost of withdrawing money

Taxes can increase the cost of withdrawing money from your MTN mobile money account. For example, if you withdraw 100,000 UGX from your MTN mobile money account in Uganda, you will be charged a withdrawal fee of 500 UGX. In addition, you will also be charged a withholding tax of 10% on the withdrawal fee, which will amount to an additional 50 UGX. This means that the total cost of withdrawing 100,000 UGX from your MTN mobile money account in Uganda will be 550 UGX.

- Facet 3: You can avoid taxes by withdrawing money from certain countries

If you are planning to withdraw money from your MTN mobile money account, you can avoid paying taxes by withdrawing money from a country that does not charge taxes on withdrawal fees. For example, MTN does not charge any taxes on withdrawal fees in Rwanda.

It is important to be aware of the taxes that may be applied to MTN withdrawal fees before you make a withdrawal. This will help you to avoid paying unnecessary fees.

Exchange Rate

The exchange rate is an important factor to consider when withdrawing money in a foreign currency. The exchange rate is the rate at which one currency is exchanged for another. It is important to be aware of the exchange rate before you make a withdrawal, as it can have a significant impact on the amount of money you receive.

MTN charges a fee for withdrawing money in a foreign currency. The fee is a percentage of the amount you are withdrawing, and it varies depending on the country you are withdrawing from. The exchange rate is also taken into account when calculating the fee.

For example, if you are withdrawing 100 euros from your MTN mobile money account in Uganda, you will be charged a fee of 5%. The exchange rate at the time of your withdrawal is 1 euro = 4,000 Ugandan shillings. This means that you will receive 3,800 Ugandan shillings after the fee is deducted.

It is important to be aware of the exchange rate and the MTN withdrawal fee before you make a withdrawal in a foreign currency. This will help you to avoid paying unnecessary fees and to get the most value for your money.

| Country | Exchange Rate (UGX/EUR) | MTN Withdrawal Fee (%) |

|---|---|---|

| Kenya | 4,200 | 5% |

| Tanzania | 4,100 | 5% |

| Rwanda | 4,000 | 5% |

| South Sudan | 3,900 | 5% |

| DR Congo | 3,800 | 5% |

Transaction limits

Transaction limits are an important factor to consider when calculating MTN charges on withdrawal. MTN has set transaction limits for all withdrawal methods, and exceeding these limits may result in additional fees.For example, the maximum amount of money that you can withdraw from an MTN agent in Uganda is 1,000,000 UGX. If you try to withdraw more than 1,000,000 UGX, you will be charged an additional fee of 1% of the amount you are withdrawing.It is important to be aware of the transaction limits before you make a withdrawal. This will help you to avoid paying unnecessary fees.

Here is a table that summarizes the MTN transaction limits for different withdrawal methods:

| Withdrawal Method | Transaction Limit |

|---|---|

| MTN Agent | 1,000,000 UGX |

| MTN ATM | 500,000 UGX |

| MTN Mobile App | 500,000 UGX |

FAQs on MTN Charges on Withdrawal

This section provides answers to frequently asked questions about MTN charges on withdrawal. Understanding these charges can help you avoid unnecessary fees and manage your mobile money transactions effectively.

Question 1: What are MTN charges on withdrawal?

MTN charges on withdrawal refer to the fees levied by MTN when you withdraw money from your MTN mobile money account. These charges vary depending on factors such as the amount withdrawn, withdrawal method, and location.

Question 2: How much are MTN charges on withdrawal?

MTN charges on withdrawal vary depending on several factors, including the amount withdrawn, withdrawal method, and location. You can find detailed information about the charges applicable to your specific transaction by visiting the MTN website or contacting their customer care.

Question 3: How can I avoid MTN charges on withdrawal?

There are several ways to avoid or minimize MTN charges on withdrawal. These include making use of free withdrawal options, withdrawing larger amounts less frequently to avoid multiple fees, and exploring alternative withdrawal methods that may offer lower charges.

Question 4: What is the maximum amount I can withdraw from my MTN mobile money account?

The maximum amount you can withdraw from your MTN mobile money account varies depending on your account type and location. You can check the MTN website or contact customer care for specific limits applicable to your account.

Question 5: Can I withdraw money from my MTN mobile money account in a foreign country?

Yes, you can withdraw money from your MTN mobile money account in a foreign country. However, additional charges may apply, and the exchange rate and other factors may affect the amount you receive.

Question 6: What should I do if I encounter any issues with MTN charges on withdrawal?

If you encounter any issues or have concerns about MTN charges on withdrawal, you can contact MTN customer care for assistance. They will investigate the matter and provide you with the necessary support.

Summary: Understanding MTN charges on withdrawal is essential for effective management of your mobile money transactions. By being aware of the charges, exploring ways to avoid or minimize them, and seeking assistance when needed, you can optimize your mobile money experience.

Transition to the next article section: This concludes our discussion on MTN charges on withdrawal. For more information on MTN mobile money services and other related topics, please continue exploring our comprehensive guide.

Tips on MTN Charges on Withdrawal

To effectively manage your mobile money transactions and avoid unnecessary fees, consider these informative tips on MTN charges on withdrawal:

Tip 1: Understand the ChargesFamiliarize yourself with the MTN charges on withdrawal, including the factors that influence these charges. Understanding the fee structure will help you plan your withdrawals and minimize costs.

Tip 2: Explore Free Withdrawal OptionsTake advantage of free withdrawal options offered by MTN, such as withdrawing from specific agents or using the MTN mobile app. These options can help you save money on transaction fees.

Tip 3: Withdraw Larger Amounts Less FrequentlyInstead of making multiple small withdrawals, consider withdrawing larger amounts less frequently. This strategy helps you avoid incurring multiple withdrawal fees and saves you money in the long run.

Tip 4: Consider Alternative Withdrawal MethodsExplore alternative withdrawal methods that may offer lower charges. For example, using bank transfers or mobile money interoperability services can sometimes be more cost-effective than withdrawing directly from an MTN agent.

Tip 5: Be Aware of Transaction LimitsPay attention to the transaction limits set by MTN for withdrawals. Exceeding these limits may result in additional fees. Knowing the limits will help you plan your withdrawals accordingly.

Tip 6: Check for Promotions and DiscountsKeep an eye out for promotions and discounts offered by MTN on withdrawal fees. These offers can help you save money and make your mobile money transactions more affordable.

Tip 7: Contact MTN Customer Care for AssistanceIf you encounter any issues or have questions about MTN charges on withdrawal, don't hesitate to contact MTN customer care. They can provide you with the necessary support and guidance.

Summary: By following these tips, you can effectively manage MTN charges on withdrawal, optimize your mobile money transactions, and save money on fees. Remember to stay informed about the latest fee structures and promotions to make the most of your MTN mobile money experience.Conclusion

In summary, MTN charges on withdrawal refer to the fees levied by MTN when you withdraw money from your MTN mobile money account. These charges vary depending on factors such as the amount withdrawn, withdrawal method, and location. Understanding the fee structure and exploring ways to avoid or minimize these charges is crucial for effective management of your mobile money transactions.

By following the tips and strategies outlined in this article, you can optimize your MTN mobile money experience and save money on withdrawal fees. Remember to stay informed about MTN's latest fee structures and promotions to make the most of your mobile financial services.

Article Recommendations