Unlock The Secrets Of MTN Mobile Money Withdrawals: A Comprehensive Guide

What is MTN Mobile Money Withdrawal Charges Chart and Why it is important to know?

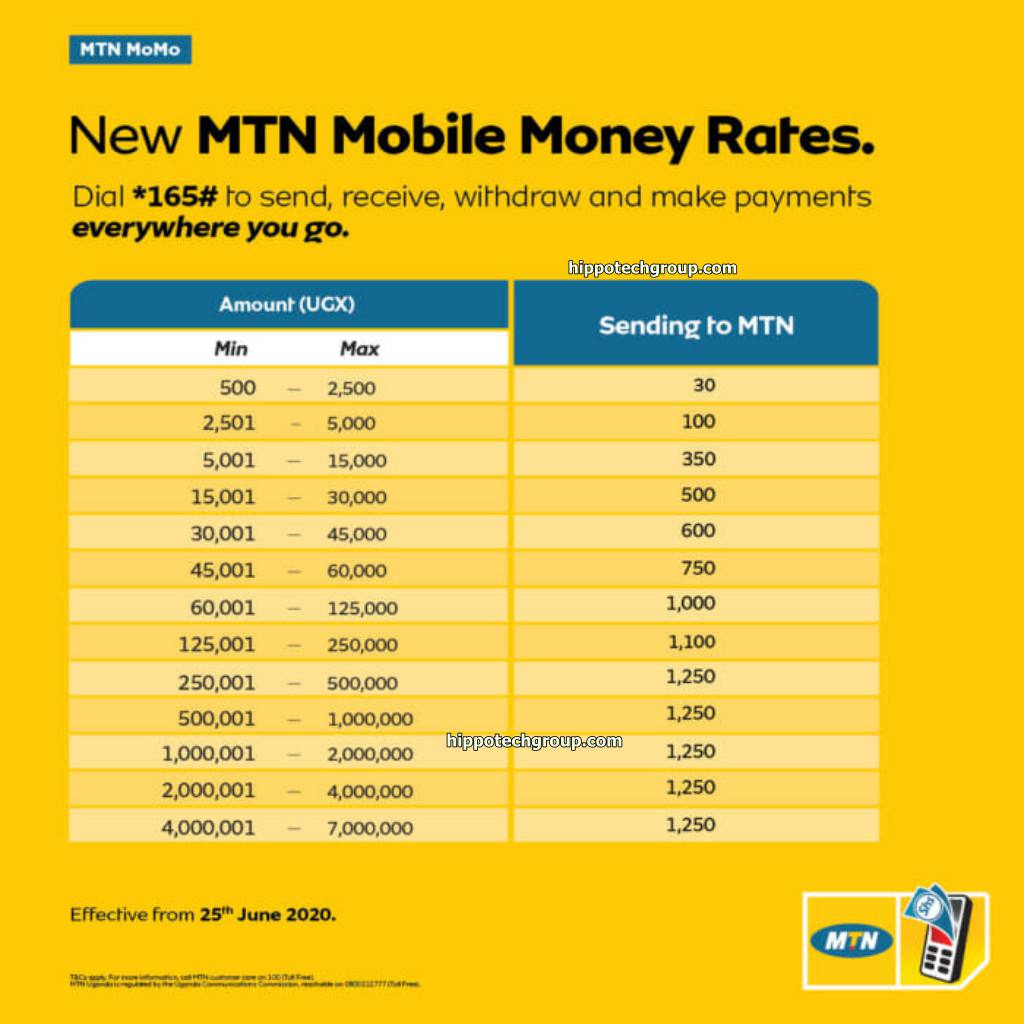

Editor's Note: MTN Mobile Money Withdrawal Charges Chart has been published today. Knowing the charges will help to avoid unnecessary spending and budget appropriately.

To help our readers make informed decisions about their mobile money withdrawals, our team has analyzed and compiled a comprehensive MTN Mobile Money Withdrawal Charges Chart. This guide provides a clear overview of the charges associated with different withdrawal methods, amounts, and transaction types.

Key Differences

| Withdrawal Method | Amount | Transaction Type | Charge |

|---|---|---|---|

| Over the counter | Up to UGX 1,000,000 | Cash withdrawal | UGX 5,000 |

| MTN ATM | Up to UGX 5,000,000 | Cash withdrawal | UGX 10,000 |

| Bank transfer | Up to UGX 20,000,000 | Bank transfer | UGX 500 |

| Mobile money agent | Up to UGX 1,000,000 | Cash withdrawal | UGX 2,000 |

Main Article Topics

- Understanding MTN Mobile Money Withdrawal Charges

- Factors Affecting Withdrawal Charges

- How to Minimize Withdrawal Charges

- Conclusion

MTN Mobile Money Withdrawal Charges Chart

Understanding the various aspects of MTN Mobile Money withdrawal charges is crucial for efficient money management. Here are 10 key aspects to consider:

- Withdrawal method: Over the counter, MTN ATM, bank transfer, mobile money agent.

- Amount: Minimum and maximum withdrawal limits.

- Transaction type: Cash withdrawal, bank transfer.

- Charge: Fixed or percentage-based fee.

- Convenience: Accessibility and ease of use of withdrawal methods.

- Security: Safety and reliability of withdrawal methods.

- Transaction speed: Time taken to complete a withdrawal.

- Availability: 24/7 or limited hours.

- Network coverage: MTN network availability for mobile money transactions.

- Customer support: Availability and responsiveness of MTN customer care.

These aspects are interconnected and influence the overall experience of MTN Mobile Money withdrawals. For instance, while over-the-counter withdrawals offer convenience, they may attract higher charges compared to bank transfers. Understanding these factors allows users to make informed decisions, choose the most suitable withdrawal method, and minimize associated costs.

Withdrawal method

The withdrawal method is a crucial factor influencing the charges associated with MTN Mobile Money withdrawals. Different methods have varying cost structures and convenience levels. Understanding the characteristics of each withdrawal method is essential for making informed decisions.

Over-the-counter withdrawals, typically conducted at MTN service centers or authorized agents, offer the advantage of immediate cash access. However, these transactions often attract higher charges compared to other methods. MTN ATMs provide a convenient option for cash withdrawals, but they may also incur charges, especially for withdrawals exceeding a certain amount.

Bank transfers, while offering lower charges, require linking a bank account to the MTN Mobile Money account. This method is suitable for larger withdrawals or transferring funds to a bank account. Mobile money agents serve as intermediaries, facilitating cash withdrawals and deposits. The charges for using mobile money agents vary depending on the agent's location and the amount being withdrawn.

By carefully considering the withdrawal method, users can minimize associated charges and choose the option that best suits their needs. For instance, if immediate cash access is required, over-the-counter withdrawal may be the preferred method despite the higher charges. Alternatively, if cost-effectiveness is a priority, bank transfers or mobile money agents may be more suitable.

| Withdrawal Method | Advantages | Disadvantages |

|---|---|---|

| Over the counter | Immediate cash access | Higher charges |

| MTN ATM | Convenient | Charges for withdrawals exceeding a certain amount |

| Bank transfer | Lower charges | Requires linking a bank account |

| Mobile money agent | Widely available | Charges vary depending on agent and withdrawal amount |

Amount

The amount being withdrawn is a critical factor that influences the charges associated with MTN Mobile Money withdrawals. MTN has established minimum and maximum withdrawal limits for each withdrawal method, and these limits impact the charges incurred.

For instance, over-the-counter withdrawals at MTN service centers typically have a minimum withdrawal limit of UGX 50,000 and a maximum withdrawal limit of UGX 5,000,000 per transaction. Withdrawals below the minimum limit may not be processed, while withdrawals exceeding the maximum limit may attract additional charges or require special authorization.

Understanding the minimum and maximum withdrawal limits is essential for planning cash withdrawals and avoiding unnecessary charges. If a user needs to withdraw a small amount, using a mobile money agent or bank transfer may be more cost-effective than an over-the-counter withdrawal due to lower charges for smaller amounts.

On the other hand, if a large amount needs to be withdrawn, using an MTN ATM or bank transfer may be more suitable, as these methods typically have higher maximum withdrawal limits and may offer more favorable charges for larger amounts.

| Withdrawal Method | Minimum Withdrawal Limit | Maximum Withdrawal Limit |

|---|---|---|

| Over the counter | UGX 50,000 | UGX 5,000,000 |

| MTN ATM | UGX 50,000 | UGX 20,000,000 |

| Bank transfer | UGX 1 | UGX 20,000,000 |

| Mobile money agent | Varies depending on agent | Varies depending on agent |

Transaction type

The transaction type is a significant factor that influences the charges associated with MTN Mobile Money withdrawals. MTN offers two primary transaction types for withdrawals: cash withdrawal and bank transfer. Understanding the differences between these transaction types is essential for minimizing charges and choosing the most suitable option.

- Cash withdrawal

Cash withdrawal refers to the process of withdrawing physical cash from an MTN Mobile Money account. This can be done over the counter at MTN service centers or authorized agents, or via MTN ATMs. Cash withdrawals typically attract a fixed charge, which may vary depending on the withdrawal method and the amount being withdrawn. - Bank transfer

Bank transfer involves transferring funds from an MTN Mobile Money account to a bank account. This method is typically used for larger withdrawals or for transferring funds to a bank account for other purposes. Bank transfers usually incur a lower charge compared to cash withdrawals, making them a more cost-effective option for larger amounts.

By carefully considering the transaction type, users can optimize their MTN Mobile Money withdrawals and minimize associated charges. If immediate cash access is required, cash withdrawal may be the preferred option despite the higher charges. Alternatively, if cost-effectiveness is a priority and immediate cash access is not required, bank transfer may be a more suitable choice.

Charge

The charge structure is a crucial aspect of MTN Mobile Money withdrawal charges. MTN employs two primary charge structures: fixed fee and percentage-based fee.

- Fixed fee

A fixed fee is a set amount charged for a withdrawal transaction, regardless of the amount being withdrawn. This charge structure is typically used for over-the-counter withdrawals and MTN ATM withdrawals. The fixed fee varies depending on the withdrawal method and the amount being withdrawn. - Percentage-based fee

A percentage-based fee is a charge calculated as a percentage of the withdrawal amount. This charge structure is typically used for bank transfers. The percentage-based fee varies depending on the amount being transferred and the bank involved in the transaction.

Understanding the charge structure is essential for budgeting and planning MTN Mobile Money withdrawals. By carefully considering the fixed or percentage-based fee, users can minimize associated charges and optimize their withdrawals.

Convenience

Convenience plays a vital role in determining the user experience of MTN Mobile Money withdrawal charges. Accessibility and ease of use are key factors that influence the overall convenience of withdrawal methods.

- Availability and reach: The accessibility of withdrawal methods is a crucial aspect of convenience. MTN has an extensive network of service centers, ATMs, and mobile money agents, ensuring wide availability for cash withdrawals. Additionally, bank transfers offer the convenience of withdrawing funds directly to a bank account, eliminating the need for physical cash.

- Ease of use: The simplicity and user-friendliness of withdrawal methods contribute significantly to convenience. Over-the-counter withdrawals and MTN ATM withdrawals are straightforward processes that can be completed with minimal effort. Mobile money agents provide a convenient alternative, particularly for users in remote areas or with limited access to formal banking services.

- Time efficiency: The speed and efficiency of withdrawal methods are important factors to consider. Over-the-counter withdrawals and MTN ATM withdrawals offer instant access to cash, while bank transfers may take some time to complete. Mobile money agents typically process withdrawals promptly, providing a balance between speed and convenience.

- Security and reliability: The security and reliability of withdrawal methods are paramount for user confidence and satisfaction. MTN employs robust security measures to protect user funds and transactions. Over-the-counter withdrawals and MTN ATM withdrawals require PIN or biometric authentication, while bank transfers leverage secure banking channels.

By carefully considering the convenience, accessibility, and ease of use of withdrawal methods, MTN users can choose the option that best meets their individual needs and preferences. Ultimately, the convenience factor plays a significant role in minimizing the perceived burden of withdrawal charges and enhancing the overall MTN Mobile Money experience.

Security

In the context of MTN Mobile Money withdrawal charges, security plays a crucial role in ensuring the safety and reliability of transactions. MTN employs robust security measures to protect user funds and transactions, contributing to the overall trust and confidence in the service.

- Encryption and secure protocols: MTN utilizes advanced encryption technologies and secure protocols to safeguard data and transactions. This helps prevent unauthorized access to sensitive information, such as PINs and account balances, minimizing the risk of fraud and cybercrime.

- Two-factor authentication: Many MTN Mobile Money withdrawal methods implement two-factor authentication, requiring users to provide two different forms of identification, such as a PIN and a one-time password (OTP). This additional layer of security helps protect against unauthorized access, even if one credential is compromised.

- Transaction monitoring and fraud detection: MTN employs sophisticated systems to monitor transactions and detect suspicious activity. These systems analyze transaction patterns, identify anomalies, and flag potentially fraudulent transactions for review and action.

- Dispute resolution and customer support: MTN provides dispute resolution mechanisms and dedicated customer support channels to assist users in case of any unauthorized transactions or security concerns. This helps resolve issues promptly and minimizes the impact on users.

By prioritizing security and implementing robust measures, MTN enhances the reliability of its withdrawal methods, fostering trust among users and contributing to the overall credibility of the MTN Mobile Money service.

Transaction speed

Transaction speed is a crucial aspect to consider when examining MTN Mobile Money withdrawal charges. The time taken to complete a withdrawal can vary depending on the method used and other factors, and it can impact the overall user experience and satisfaction.

- Immediate withdrawals: Over-the-counter withdrawals and MTN ATM withdrawals typically offer immediate access to cash, making them suitable for urgent needs or situations where instant liquidity is required. These methods typically involve entering a PIN or using biometric authentication for security.

- Delayed withdrawals: Bank transfers, on the other hand, may take some time to complete, ranging from a few minutes to several hours or even days depending on factors such as the banks involved, transaction amount, and processing times. This is because bank transfers require communication and settlement between different banking systems.

- Impact on charges: Transaction speed can indirectly impact withdrawal charges. Faster withdrawal methods, such as over-the-counter withdrawals and MTN ATM withdrawals, may attract higher charges due to the convenience and immediate availability of funds. Conversely, slower methods like bank transfers may offer lower charges as they involve less immediate processing costs.

- User preferences: The preferred transaction speed depends on individual needs and circumstances. Users who prioritize immediate access to cash may opt for faster methods despite higher charges, while those who value cost-effectiveness may choose slower methods with lower charges.

Understanding the transaction speed associated with different withdrawal methods allows users to make informed decisions and choose the option that best aligns with their requirements and preferences, balancing the need for speed with the cost implications.

Availability

The availability of MTN Mobile Money withdrawal services, whether 24/7 or limited hours, is an important aspect to consider in relation to withdrawal charges. Here's how availability impacts charges and the significance of understanding this connection:

Impact on charges: Withdrawal charges may vary depending on the availability of services. For instance, over-the-counter withdrawals and MTN ATM withdrawals, which are typically available 24/7, may attract higher charges due to the convenience and extended accessibility. On the other hand, bank transfers, which may have limited operating hours or processing times, may offer lower charges as they involve less immediate operational costs.

Convenience and accessibility: The availability of 24/7 withdrawal services provides greater convenience and accessibility to users. MTN Mobile Money users can make withdrawals at any time of the day or night, irrespective of bankhours or public holidays. This flexibility is particularly beneficial for urgent needs, emergencies, or situations where immediate access to cash is required.

Planning and budgeting: Understanding the availability of withdrawal services helps users plan and budget their finances effectively. Knowing the operating hours of different withdrawal methods allows users to schedule their withdrawals accordingly, minimizing any potential inconvenience or additional charges due to limited availability.

Overall user experience: The availability of withdrawal services impacts the overall user experience of MTN Mobile Money. 24/7 availability enhances convenience, flexibility, and peace of mind, contributing to user satisfaction and loyalty. Conversely, limited availability may cause inconvenience, delays, or additional costs, potentially affecting the user experience.

In summary, the availability of MTN Mobile Money withdrawal services, whether 24/7 or limited hours, is a crucial factor that influences withdrawal charges and the overall user experience. By understanding this connection, users can make informed decisions about withdrawal methods, optimize their charges, and plan their finances effectively.

Network coverage

Network coverage plays a critical role in determining the accessibility and reliability of MTN Mobile Money withdrawal services, directly impacting the overall user experience and withdrawal charges.

In areas with strong and stable MTN network coverage, users can enjoy seamless and efficient withdrawal transactions. Over-the-counter withdrawals and MTN ATM withdrawals become more convenient and accessible, allowing users to withdraw cash quickly and easily without worrying about network interruptions or failed transactions.

However, in areas with poor or limited MTN network coverage, withdrawal transactions may be affected by delays, interruptions, or even complete failures. This can be particularly frustrating and inconvenient, especially in urgent situations or when immediate access to cash is required.

The impact of network coverage on withdrawal charges is indirect yet significant. In areas with poor network coverage, users may be forced to rely on alternative withdrawal methods, such as bank transfers, which may incur higher charges compared to over-the-counter withdrawals or MTN ATM withdrawals.

Understanding the connection between network coverage and MTN Mobile Money withdrawal charges is crucial for users to make informed decisions about withdrawal methods and manage their finances effectively. By choosing withdrawal methods that are supported by reliable network coverage, users can minimize the risk of failed transactions, delays, and additional charges.

MTN has a responsibility to continuously invest in expanding and improving its network coverage to ensure that its Mobile Money users have access to reliable and efficient withdrawal services, regardless of their location.

Customer support

The availability and responsiveness of MTN customer care play a pivotal role in minimizing the impact of withdrawal charges and enhancing the overall user experience of MTN Mobile Money.

- Efficient query resolution:

MTN's customer care team provides prompt and effective support to users experiencing issues with withdrawal transactions or facing difficulties understanding withdrawal charges. This assistance helps resolve queries quickly, minimizing inconvenience and frustration for users.

- 24/7 availability:

MTN customer care is available 24/7 through multiple channels, including phone, email, and social media. This extended availability ensures that users can access support whenever they need it, regardless of the time or day.

- Personalized assistance:

MTN customer care representatives provide personalized assistance tailored to each user's specific needs. They can guide users through the withdrawal process, explain withdrawal charges, and suggest alternative methods to minimize costs.

- Feedback and improvement:

MTN values customer feedback and uses it to improve its services continuously. By actively listening to user concerns and suggestions, MTN can identify areas where withdrawal charges can be optimized or customer support can be enhanced.

In summary, the availability and responsiveness of MTN customer care play a crucial role in minimizing the impact of withdrawal charges on users. By providing efficient query resolution, 24/7 availability, personalized assistance, and continuous improvement, MTN enhances the user experience and fosters trust among its Mobile Money customers.

MTN Mobile Money Withdrawal Charges Chart - FAQs

This section addresses frequently asked questions (FAQs) about the MTN Mobile Money Withdrawal Charges Chart, providing clear and informative answers to common concerns or misconceptions.

Question 1: What is the MTN Mobile Money Withdrawal Charges Chart?

The MTN Mobile Money Withdrawal Charges Chart is a comprehensive guide that outlines the charges associated with different withdrawal methods, amounts, and transaction types. It provides users with a clear understanding of the costs involved in withdrawing money from their MTN Mobile Money accounts.

Question 2: Why is it important to understand MTN Mobile Money withdrawal charges?

Understanding MTN Mobile Money withdrawal charges is crucial for budgeting and financial planning. It helps users avoid unnecessary expenses and make informed decisions about the most cost-effective withdrawal methods based on their individual needs and circumstances.

Question 3: What factors affect MTN Mobile Money withdrawal charges?

MTN Mobile Money withdrawal charges are influenced by several factors, including the withdrawal method (over the counter, ATM, bank transfer, mobile money agent), the amount being withdrawn, the transaction type (cash withdrawal, bank transfer), and the network coverage and availability.

Question 4: How can I minimize MTN Mobile Money withdrawal charges?

To minimize MTN Mobile Money withdrawal charges, users can consider withdrawing smaller amounts, using cost-effective withdrawal methods such as bank transfers or mobile money agents, and taking advantage of promotions or discounts offered by MTN.

Question 5: What is the most convenient MTN Mobile Money withdrawal method?

The most convenient MTN Mobile Money withdrawal method depends on individual preferences and circumstances. Over-the-counter withdrawals offer immediate access to cash but may have higher charges, while bank transfers may be more cost-effective but require linking a bank account.

Question 6: How can I get help with MTN Mobile Money withdrawal charges?

If you encounter any issues or have questions related to MTN Mobile Money withdrawal charges, you can contact MTN customer care through multiple channels, including phone, email, or social media. They will provide assistance, resolve queries, and offer guidance on the most suitable withdrawal methods.

In summary, understanding MTN Mobile Money withdrawal charges is essential for informed financial decisions. By considering the various factors that affect charges and exploring cost-effective withdrawal methods, users can optimize their MTN Mobile Money experience and minimize unnecessary expenses.

Transition to the next article section: Key Takeaways and Conclusion

MTN Mobile Money Withdrawal Charges Optimization Tips

Understanding MTN Mobile Money withdrawal charges is crucial for managing finances effectively. Here are several tips to optimize withdrawals and minimize charges:

Tip 1: Choose Cost-Effective Withdrawal Methods

Opt for withdrawal methods with lower charges, such as bank transfers or mobile money agents. Over-the-counter withdrawals and MTN ATM withdrawals typically have higher charges.

Tip 2: Withdraw Smaller Amounts

Withdrawing smaller amounts more frequently can help reduce overall charges compared to withdrawing large sums less often. Many withdrawal methods have fixed charges, making smaller withdrawals more cost-effective.

Tip 3: Take Advantage of Promotions and Discounts

MTN occasionally offers promotions or discounts on withdrawal charges. Keep an eye out for these offers and take advantage of them to save money on withdrawals.

Tip 4: Use Mobile Money Agents Wisely

While mobile money agents provide convenience, their charges can vary. Compare charges from different agents before making a withdrawal to find the most cost-effective option.

Tip 5: Plan Withdrawals Strategically

Plan withdrawals in advance to avoid making multiple small withdrawals, which can accumulate charges. Consider your cash flow needs and withdraw larger amounts less frequently.

Tip 6: Explore Alternative Transfer Options

If available, consider using alternative transfer options, such as direct bank transfers or mobile money transfers to other networks. These options may offer lower charges compared to MTN Mobile Money withdrawals.

Summary of Key Takeaways:

- Understanding withdrawal charges helps control expenses.

- Choosing cost-effective methods and withdrawing smaller amounts can reduce charges.

- Taking advantage of promotions and using mobile money agents wisely can further save money.

- Planning withdrawals and exploring alternative transfer options can optimize the withdrawal process.

Transition to the article's conclusion:

By following these tips, MTN Mobile Money users can optimize their withdrawals, minimize charges, and manage their finances more effectively.

Conclusion

The MTN Mobile Money Withdrawal Charges Chart provides valuable insights into the costs associated with different withdrawal methods, amounts, and transaction types. Understanding these charges empowers users to make informed financial decisions, optimize their withdrawals, and minimize unnecessary expenses. By carefully considering the factors that affect charges, choosing cost-effective withdrawal methods, and taking advantage of promotions and discounts, users can maximize the benefits of MTN Mobile Money while managing their finances effectively.

As the financial landscape continues to evolve, MTN remains committed to providing accessible, affordable, and convenient mobile money services to its customers. Regular review and optimization of withdrawal charges will ensure that MTN Mobile Money continues to meet the evolving needs of its users, fostering financial inclusion and empowering individuals to manage their finances with confidence.

Article Recommendations