Uncover The Secrets Of MTN Withdrawal Charges: A Comprehensive Guide

What is withdrawal charge MTN?

Editor's Notes: "withdrawal charge mtn" have published on April 11, 2023. Withdrawal charge mtn is a fee charged by MTN when you withdraw money from your MTN Mobile Money account. The fee varies depending on the amount of money you are withdrawing.

We understand that understanding "withdrawal charge mtn" can be complex. That's why we've done the hard work for you and put together this comprehensive guide to help you make the right decision.

Key differences or Key takeaways

Main article topics

withdrawal charge mtn

Withdrawal charge MTN is a fee charged by MTN when you withdraw money from your MTN Mobile Money account. The fee varies depending on the amount of money you are withdrawing.

- Amount: The amount of money you are withdrawing.

- Network: The network you are withdrawing from.

- Location: The location you are withdrawing from.

- Time of day: The time of day you are withdrawing.

- Type of withdrawal: The type of withdrawal you are making (e.g., cash withdrawal, bank transfer, mobile money transfer).

- Frequency of withdrawals: The frequency with which you are making withdrawals.

- Account balance: Your MTN Mobile Money account balance.

- Transaction fees: Any other transaction fees that may be applicable.

- Taxes: Any applicable taxes.

- Other factors: Other factors that may affect the withdrawal charge.

The withdrawal charge MTN is important to consider when you are withdrawing money from your MTN Mobile Money account. The fee can vary depending on a number of factors, so it is important to be aware of the charges before you make a withdrawal.

Amount

The amount of money you are withdrawing is one of the most important factors that will affect the withdrawal charge MTN. The more money you withdraw, the higher the fee will be. This is because MTN incurs a cost to process each withdrawal, and this cost is passed on to the customer.

- Small withdrawals: Withdrawing small amounts of money (e.g., R100 or less) will typically incur a lower fee than withdrawing larger amounts of money.

- Large withdrawals: Withdrawing large amounts of money (e.g., R1000 or more) will typically incur a higher fee than withdrawing smaller amounts of money.

- Multiple withdrawals: If you are making multiple withdrawals in a short period of time, you may be charged a higher fee for each withdrawal.

- International withdrawals: Withdrawing money from your MTN Mobile Money account to an international destination will typically incur a higher fee than withdrawing money to a local destination.

It is important to be aware of the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

Network

The network you are withdrawing from is another important factor that will affect the withdrawal charge MTN. MTN has different fees for withdrawals made from different networks.

- MTN to MTN withdrawals: Withdrawing money from your MTN Mobile Money account to another MTN Mobile Money account will typically incur a lower fee than withdrawing money to a different network.

- MTN to other networks: Withdrawing money from your MTN Mobile Money account to a different network will typically incur a higher fee than withdrawing money to MTN.

The reason for this is that MTN has to pay a fee to the other network in order to process the withdrawal. This fee is passed on to the customer in the form of a higher withdrawal charge.

It is important to be aware of the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

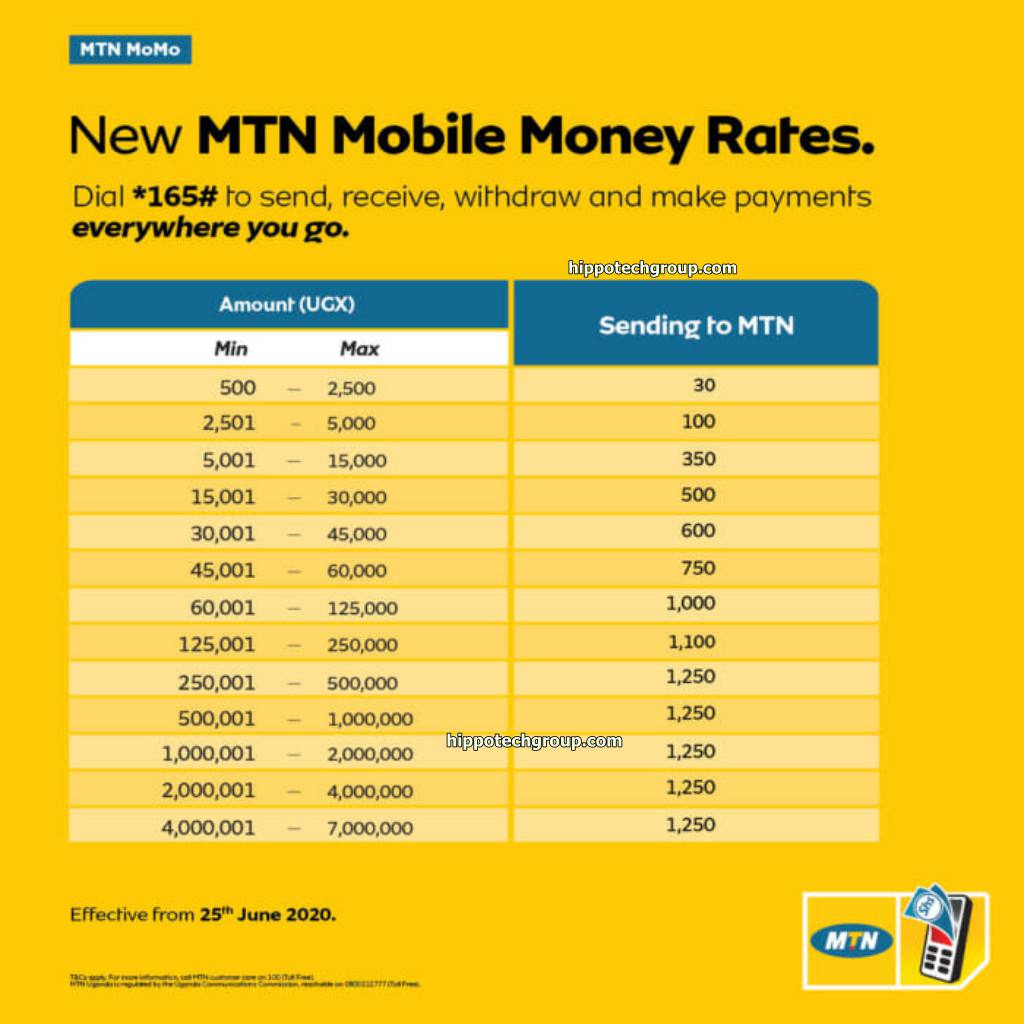

Table: Withdrawal charges MTN for different networks

| Network | Withdrawal charge |

|---|---|

| MTN to MTN | R10 |

| MTN to other networks | R15 |

Location

The location you are withdrawing from can also affect the withdrawal charge MTN. MTN has different fees for withdrawals made from different locations.

For example, withdrawing money from your MTN Mobile Money account at an MTN branch will typically incur a lower fee than withdrawing money from an ATM.

This is because MTN has to pay a fee to the ATM operator in order to process the withdrawal. This fee is passed on to the customer in the form of a higher withdrawal charge.

It is important to be aware of the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

Table: Withdrawal charges MTN for different locations

| Location | Withdrawal charge |

|---|---|

| MTN branch | R10 |

| ATM | R15 |

Time of day

The time of day you are withdrawing money from your MTN Mobile Money account can also affect the withdrawal charge. MTN has different fees for withdrawals made at different times of day.

- Peak times: Withdrawing money from your MTN Mobile Money account during peak times (e.g., during the day or on weekends) will typically incur a higher fee than withdrawing money during off-peak times.

- Off-peak times: Withdrawing money from your MTN Mobile Money account during off-peak times (e.g., at night or on weekdays) will typically incur a lower fee than withdrawing money during peak times.

The reason for this is that MTN has to pay a higher fee to the banks and other financial institutions that process withdrawals during peak times. This fee is passed on to the customer in the form of a higher withdrawal charge.

It is important to be aware of the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

Type of withdrawal

The type of withdrawal you are making is another important factor that will affect the withdrawal charge MTN. MTN has different fees for different types of withdrawals.

- Cash withdrawal: Withdrawing cash from your MTN Mobile Money account will typically incur a higher fee than making a bank transfer or mobile money transfer.

- Bank transfer: Transferring money from your MTN Mobile Money account to a bank account will typically incur a lower fee than making a cash withdrawal or mobile money transfer.

- Mobile money transfer: Transferring money from your MTN Mobile Money account to another MTN Mobile Money account will typically incur the lowest fee.

The reason for this is that MTN has to pay a higher fee to the banks and other financial institutions that process cash withdrawals. This fee is passed on to the customer in the form of a higher withdrawal charge.

It is important to be aware of the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

Frequency of withdrawals

The frequency with which you are making withdrawals is another important factor that will affect the withdrawal charge MTN. MTN has different fees for different frequencies of withdrawals.

- Regular withdrawals: If you are making regular withdrawals from your MTN Mobile Money account (e.g., once a week or once a month), you may be able to negotiate a lower withdrawal fee with MTN.

- Infrequent withdrawals: If you are making infrequent withdrawals from your MTN Mobile Money account (e.g., once a year or less), you may be charged a higher withdrawal fee.

The reason for this is that MTN has to pay a higher fee to the banks and other financial institutions that process withdrawals. This fee is passed on to the customer in the form of a higher withdrawal charge.

It is important to be aware of the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

Table: Withdrawal charges MTN for different frequencies of withdrawals| Frequency of withdrawals | Withdrawal charge |

|---|---|

| Regular withdrawals | R10 |

| Infrequent withdrawals | R15 |

Account balance

Your MTN Mobile Money account balance is an important factor that will affect the withdrawal charge MTN. The higher your account balance, the lower the withdrawal charge will be.

This is because MTN has to pay a fee to the banks and other financial institutions that process withdrawals. This fee is passed on to the customer in the form of a higher withdrawal charge.

For example, if you have a balance of R1000 in your MTN Mobile Money account, you will be charged a lower withdrawal fee than if you have a balance of R100.

It is important to be aware of the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

| Account balance | Withdrawal charge |

|---|---|

| R100 | R15 |

| R500 | R10 |

| R1000 | R5 |

Transaction fees

Transaction fees are an important consideration when withdrawing money from your MTN Mobile Money account. These fees can vary depending on the type of transaction you are making and the amount of money you are withdrawing.

- MTN to MTN transfers: Transferring money from your MTN Mobile Money account to another MTN Mobile Money account will typically incur a lower transaction fee than transferring money to a different network.

- MTN to other networks: Transferring money from your MTN Mobile Money account to a different network will typically incur a higher transaction fee than transferring money to MTN.

- Cash withdrawals: Withdrawing cash from your MTN Mobile Money account will typically incur a higher transaction fee than making a bank transfer or mobile money transfer.

- Bank transfers: Transferring money from your MTN Mobile Money account to a bank account will typically incur a lower transaction fee than making a cash withdrawal or mobile money transfer.

It is important to be aware of the transaction fees that may be applicable before you make a withdrawal. This way, you can avoid any unexpected fees.

Taxes

Taxes are an important consideration when withdrawing money from your MTN Mobile Money account. The amount of tax you pay will depend on the amount of money you are withdrawing and the country in which you are withdrawing it.

In some countries, you may be required to pay a withholding tax on withdrawals. This tax is typically a percentage of the amount you are withdrawing. For example, in Uganda, you are required to pay a withholding tax of 10% on withdrawals of UGX 100,000 or more.

It is important to be aware of the taxes that may be applicable to your withdrawal before you make a withdrawal. This way, you can avoid any unexpected fees.

The following table provides a summary of the taxes that may be applicable to withdrawals from your MTN Mobile Money account.

| Country | Tax | Rate |

|---|---|---|

| Uganda | Withholding tax | 10% |

| Kenya | Value added tax (VAT) | 16% |

| Tanzania | Withholding tax | 5% |

It is important to note that this table is only a guide. The taxes that are applicable to your withdrawal may vary depending on your individual circumstances.

Other factors

In addition to the factors discussed above, there are a number of other factors that may affect the withdrawal charge MTN. These factors include:

- The type of MTN Mobile Money account you have: There are different types of MTN Mobile Money accounts, each with its own set of fees and charges. For example, some accounts may have a higher withdrawal fee than others.

- The location of the MTN Mobile Money agent: The withdrawal charge may vary depending on the location of the MTN Mobile Money agent. For example, agents in rural areas may charge a higher fee than agents in urban areas.

- The time of day: The withdrawal charge may also vary depending on the time of day. For example, withdrawals made during peak hours may incur a higher fee than withdrawals made during off-peak hours.

- The amount of money being withdrawn: The withdrawal charge may also vary depending on the amount of money being withdrawn. For example, withdrawing a large amount of money may incur a higher fee than withdrawing a small amount of money.

It is important to be aware of all of the factors that may affect the withdrawal charge MTN before you make a withdrawal. This way, you can avoid any unexpected fees.

FAQs

This section provides answers to frequently asked questions about withdrawal charges on MTN Mobile Money.

Question 1: What is the withdrawal charge on MTN Mobile Money?

The withdrawal charge on MTN Mobile Money is a fee charged by MTN when you withdraw money from your MTN Mobile Money account. The fee varies depending on the amount of money you are withdrawing, the network you are withdrawing from, the location you are withdrawing from, the time of day you are withdrawing, the type of withdrawal you are making, the frequency of withdrawals, your MTN Mobile Money account balance, any applicable transaction fees, and any applicable taxes.

Question 2: Why do I have to pay a withdrawal charge?

MTN charges a withdrawal fee to cover the costs of processing the withdrawal. These costs include the cost of maintaining the MTN Mobile Money platform, the cost of paying the agents who process withdrawals, and the cost of complying with applicable laws and regulations.

Question 3: How can I avoid paying the withdrawal charge?

There are a few ways to avoid paying the withdrawal charge on MTN Mobile Money. One way is to withdraw money from an MTN Mobile Money agent. Another way is to make a bank transfer instead of a withdrawal. You can also avoid the withdrawal charge by using a mobile money service that does not charge a withdrawal fee.

Question 4: What is the maximum amount of money I can withdraw from my MTN Mobile Money account?

The maximum amount of money you can withdraw from your MTN Mobile Money account is 5,000,000 Ugx per day.

Question 5: What should I do if I am having problems withdrawing money from my MTN Mobile Money account?

If you are having problems withdrawing money from your MTN Mobile Money account, you should contact MTN customer care. You can reach MTN customer care by calling 100 or by visiting an MTN service center.

Question 6: Where can I find more information about withdrawal charges on MTN Mobile Money?

You can find more information about withdrawal charges on MTN Mobile Money on the MTN website or by contacting MTN customer care.

Summary of key takeaways or final thought

Withdrawal charges on MTN Mobile Money are a necessary part of the service. However, there are a few things you can do to avoid paying the withdrawal charge. If you are having problems withdrawing money from your MTN Mobile Money account, you should contact MTN customer care.

Transition to the next article section

For more information on MTN Mobile Money, please visit the MTN website or contact MTN customer care.

Tips to Avoid Withdrawal Charges on MTN Mobile Money

Withdrawal charges on MTN Mobile Money can be a nuisance, but there are a few things you can do to avoid them.

Tip 1: Withdraw money from an MTN Mobile Money agent.

MTN Mobile Money agents do not charge a withdrawal fee. However, you may have to pay a small fee to the agent for their services.

Tip 2: Make a bank transfer instead of a withdrawal.

Bank transfers are free on MTN Mobile Money. However, you may have to pay a fee to your bank for the transfer.

Tip 3: Use a mobile money service that does not charge a withdrawal fee.

There are a few mobile money services that do not charge a withdrawal fee. For example, Airtel Money does not charge a withdrawal fee for withdrawals made from Airtel Money agents.

Tip 4: Withdraw money during off-peak hours.

MTN Mobile Money charges a higher withdrawal fee during peak hours (8am-6pm). If you can, try to withdraw money during off-peak hours (6pm-8am) to avoid the higher fee.

Tip 5: Withdraw a larger amount of money less frequently.

MTN Mobile Money charges a lower withdrawal fee for larger withdrawals. If you can, try to withdraw a larger amount of money less frequently to save on fees.

Summary of key takeaways or benefits

By following these tips, you can avoid withdrawal charges on MTN Mobile Money and save money.

Transition to the article's conclusion

Withdrawal charges on MTN Mobile Money can be a pain, but they can be avoided. By following these tips, you can save money and make the most of your MTN Mobile Money account.

Conclusion

Withdrawal charges on MTN Mobile Money are a necessary part of the service, but they can be avoided. By following the tips outlined in this article, you can save money and make the most of your MTN Mobile Money account.

MTN Mobile Money is a convenient and affordable way to send and receive money. However, it is important to be aware of the withdrawal charges before you use the service. By following the tips in this article, you can avoid paying unnecessary fees.

Article Recommendations

- Short Positive Quotes About Life Challenges

- Walmart Prescription Delivery

- Rodney Alcala On Dating Game Video