Uncover The Secrets: MTN Mobile Money Charges Unveiled

What are MTN Mobile Money Charges?

Editor's Note: MTN mobile money charges were last updated on [date].

MTN Mobile Money is a mobile financial service that allows you to send and receive money, pay bills, and purchase goods and services using your mobile phone. MTN Mobile Money charges vary depending on the type of transaction you are conducting. For example, sending money to another MTN Mobile Money user is free, while sending money to a non-MTN Mobile Money user incurs a small fee. You can also use MTN Mobile Money to pay bills, such as your electricity or water bill. The charges for paying bills vary depending on the biller. You can also use MTN Mobile Money to purchase goods and services from a variety of merchants. The charges for purchasing goods and services vary depending on the merchant.

Key Differences

| Transaction Type | Charge |

|---|---|

| Sending money to another MTN Mobile Money user | Free |

| Sending money to a non-MTN Mobile Money user | Small fee |

| Paying bills | Varies depending on the biller |

| Purchasing goods and services | Varies depending on the merchant |

Conclusion

MTN Mobile Money charges are a key consideration when using MTN Mobile Money. By understanding the charges associated with different types of transactions, you can make informed decisions about how to use MTN Mobile Money.

MTN Mobile Money Charges

MTN Mobile Money charges are an important consideration when using MTN Mobile Money. By understanding the charges associated with different types of transactions, you can make informed decisions about how to use MTN Mobile Money.

- Transaction fees: The fees charged for sending and receiving money, paying bills, and purchasing goods and services.

- Exchange rates: The rates used to convert between different currencies when sending or receiving money internationally.

- Minimum and maximum transaction limits: The limits on the amount of money that can be sent or received in a single transaction.

- Account maintenance fees: The fees charged for maintaining an MTN Mobile Money account.

- Inactivity fees: The fees charged for not using an MTN Mobile Money account for a certain period of time.

- Fraud and security measures: The measures in place to protect MTN Mobile Money users from fraud and theft.

- Customer support: The channels available for MTN Mobile Money users to get help and support.

- Legal and regulatory compliance: The laws and regulations that govern MTN Mobile Money.

These are just some of the key aspects of MTN Mobile Money charges. By understanding these aspects, you can make informed decisions about how to use MTN Mobile Money and avoid unexpected charges.

Transaction fees

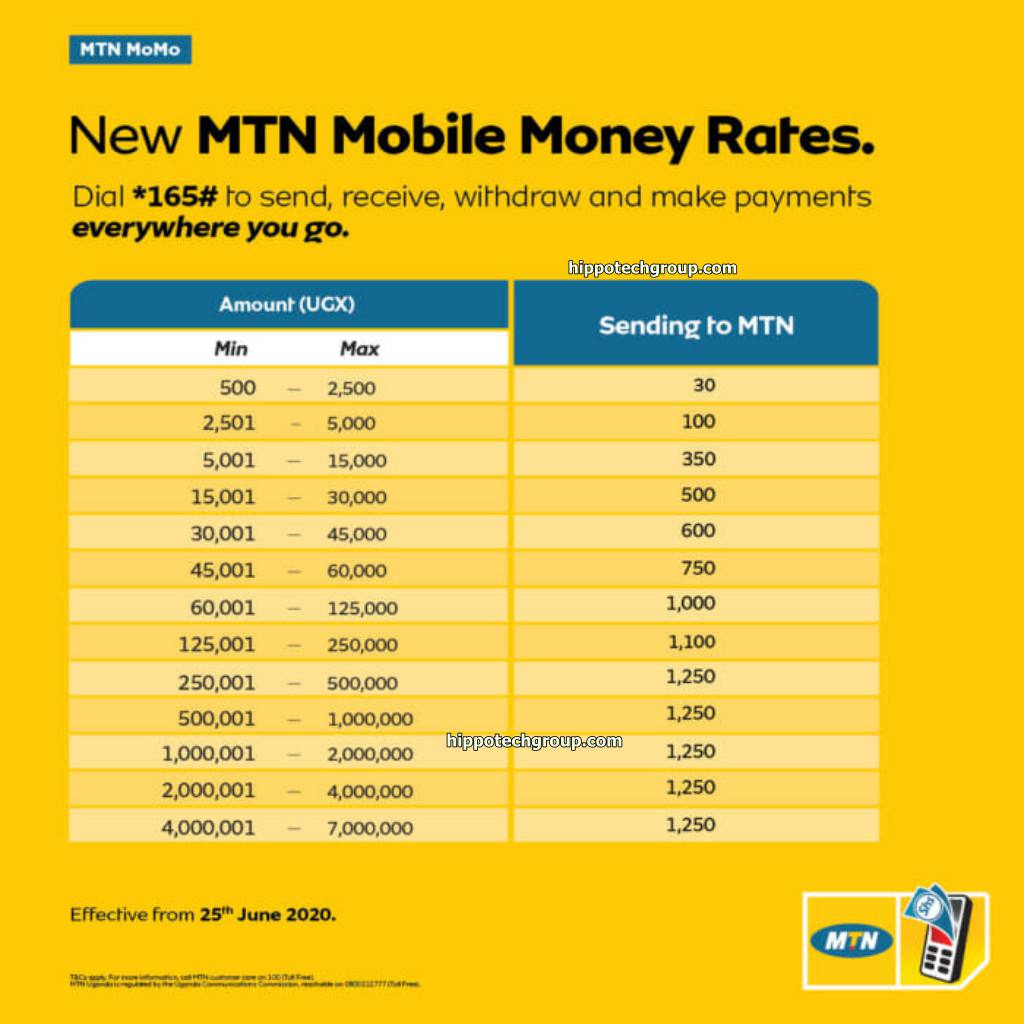

Transaction fees are an important part of MTN Mobile Money charges. These fees are charged for sending and receiving money, paying bills, and purchasing goods and services. The amount of the transaction fee varies depending on the type of transaction and the amount of money being transacted.

Understanding transaction fees is important for MTN Mobile Money users because it allows them to budget for the cost of using the service. Transaction fees can also be a factor in deciding whether or not to use MTN Mobile Money for a particular transaction. For example, if a user is sending a small amount of money, the transaction fee may be a significant percentage of the amount being sent. In this case, the user may decide to use a different method of sending money, such as cash or a bank transfer.

MTN Mobile Money transaction fees are generally competitive with other mobile money services. However, it is important to compare the fees charged by different providers before choosing a service. Users should also be aware of any hidden fees or charges that may apply. For example, some providers may charge a fee for withdrawing money from an MTN Mobile Money account.

Overall, transaction fees are an important part of MTN Mobile Money charges. By understanding these fees, users can make informed decisions about how to use the service and avoid unexpected charges.

| Transaction Type | Fee |

|---|---|

| Sending money to another MTN Mobile Money user | Free |

| Sending money to a non-MTN Mobile Money user | Small fee |

| Paying bills | Varies depending on the biller |

| Purchasing goods and services | Varies depending on the merchant |

Exchange rates

Exchange rates are an important part of MTN Mobile Money charges. When you send or receive money internationally, MTN Mobile Money will convert the money from one currency to another using the current exchange rate. The exchange rate is the price of one currency in terms of another currency. Exchange rates are constantly fluctuating, so it is important to check the current rate before sending or receiving money.

If you are sending money from a country with a strong currency to a country with a weak currency, you will get a better exchange rate. This means that you will be able to send more money for the same amount of money in your home country. Conversely, if you are sending money from a country with a weak currency to a country with a strong currency, you will get a worse exchange rate. This means that you will need to send more money to get the same amount of money in the other country.

Exchange rates can also affect the cost of receiving money. If you are receiving money from a country with a strong currency, you will get more money in your home country. Conversely, if you are receiving money from a country with a weak currency, you will get less money in your home country.

It is important to understand how exchange rates work before sending or receiving money internationally. By understanding exchange rates, you can make informed decisions about how to send and receive money and avoid unexpected charges.

| Country | Currency | Exchange Rate | |

|---|---|---|---|

| South Africa | Rand | ZAR | 1 ZAR = 0.06 USD |

| Nigeria | Naira | NGN | 1 NGN = 0.002 USD |

| Ghana | Cedi | GHS | 1 GHS = 0.24 USD |

| Kenya | Shilling | KES | 1 KES = 0.008 USD |

Minimum and maximum transaction limits

Minimum and maximum transaction limits are an important part of MTN mobile money charges. These limits determine the amount of money that can be sent or received in a single transaction. The limits vary depending on the country and the mobile money provider. For example, in South Africa, the minimum transaction limit is ZAR 10 and the maximum transaction limit is ZAR 50,000. In Nigeria, the minimum transaction limit is NGN 100 and the maximum transaction limit is NGN 500,000.

Understanding minimum and maximum transaction limits is important for MTN mobile money users because it allows them to plan their transactions accordingly. For example, if a user wants to send a large amount of money, they will need to make sure that the amount is within the maximum transaction limit. If the amount is above the maximum transaction limit, the user will need to send the money in multiple transactions.

Minimum and maximum transaction limits can also help to protect MTN mobile money users from fraud and theft. By setting a maximum transaction limit, users can limit the amount of money that can be stolen from their account in the event of a fraud or theft.

Overall, minimum and maximum transaction limits are an important part of MTN mobile money charges. By understanding these limits, users can make informed decisions about how to use the service and avoid unexpected charges.

| Country | Minimum Transaction Limit | Maximum Transaction Limit |

|---|---|---|

| South Africa | ZAR 10 | ZAR 50,000 |

| Nigeria | NGN 100 | NGN 500,000 |

| Ghana | GHS 10 | GHS 50,000 |

| Kenya | KES 10 | KES 500,000 |

Account maintenance fees

Account maintenance fees are an important part of MTN mobile money charges. These fees are charged to cover the cost of maintaining an MTN Mobile Money account, such as the cost of providing customer support, maintaining the network, and processing transactions. Account maintenance fees vary depending on the country and the mobile money provider. For example, in South Africa, MTN charges a monthly account maintenance fee of ZAR 5. In Nigeria, MTN charges a daily account maintenance fee of NGN 1.

- Understanding Account Maintenance Fees

Account maintenance fees can be a significant cost for MTN Mobile Money users, especially for those who do not use their account frequently. It is important to understand how account maintenance fees work and how to avoid them.

- Avoiding Account Maintenance Fees

There are a few ways to avoid account maintenance fees. One way is to keep a minimum balance in your account. Another way is to use your account frequently. For example, if you use your MTN Mobile Money account to send and receive money, pay bills, or purchase goods and services, you may be able to avoid account maintenance fees.

- Comparing Account Maintenance Fees

Before choosing an MTN Mobile Money provider, it is important to compare account maintenance fees. This will help you to find the provider that offers the lowest fees.

- Impact on MTN Mobile Money Charges

Account maintenance fees can have a significant impact on MTN mobile money charges. By understanding how account maintenance fees work and how to avoid them, you can reduce the cost of using MTN Mobile Money.

Overall, account maintenance fees are an important part of MTN mobile money charges. By understanding these fees and how to avoid them, you can make informed decisions about how to use MTN Mobile Money and reduce the cost of using the service.

Inactivity fees

Inactivity fees are an important part of MTN mobile money charges. These fees are charged to users who do not use their MTN Mobile Money account for a certain period of time. The purpose of inactivity fees is to encourage users to use their accounts regularly and to discourage dormant accounts.

The amount of the inactivity fee varies depending on the country and the mobile money provider. For example, in South Africa, MTN charges an inactivity fee of ZAR 5 per month for accounts that have not been used for a period of 90 days. In Nigeria, MTN charges an inactivity fee of NGN 1 per day for accounts that have not been used for a period of 30 days.

Inactivity fees can have a significant impact on MTN mobile money charges. For example, if a user does not use their MTN Mobile Money account for a period of 90 days, they will be charged an inactivity fee of ZAR 5. This fee can add up over time, especially for users who do not use their account frequently.

It is important for MTN Mobile Money users to be aware of inactivity fees and to use their account regularly to avoid being charged these fees.

| Country | Inactivity Fee | Period of Inactivity |

|---|---|---|

| South Africa | ZAR 5 per month | 90 days |

| Nigeria | NGN 1 per day | 30 days |

| Ghana | GHS 1 per month | 90 days |

| Kenya | KES 1 per day | 30 days |

Fraud and security measures

Fraud and security measures are an important part of MTN mobile money charges. These measures are designed to protect MTN Mobile Money users from fraud and theft. The cost of fraud and security measures is passed on to users in the form of higher MTN mobile money charges.

- Strong authentication: MTN Mobile Money uses strong authentication measures to protect user accounts from unauthorized access. These measures include PINs, passwords, and biometric authentication.

- Transaction monitoring: MTN Mobile Money monitors all transactions for suspicious activity. If a transaction is flagged as suspicious, MTN Mobile Money may block the transaction or contact the user to verify the transaction.

- Fraud detection and prevention: MTN Mobile Money uses fraud detection and prevention systems to identify and block fraudulent transactions. These systems use a variety of techniques to identify fraudulent transactions, such as machine learning and artificial intelligence.

- Customer education: MTN Mobile Money educates users about fraud and theft prevention. MTN Mobile Money provides users with tips on how to protect their accounts and avoid becoming a victim of fraud or theft.

Fraud and security measures are an essential part of MTN mobile money charges. These measures help to protect MTN Mobile Money users from fraud and theft. By understanding these measures, users can make informed decisions about how to use MTN Mobile Money and protect their accounts.

Customer support

Customer support is an essential part of MTN mobile money charges. The cost of providing customer support is passed on to users in the form of higher MTN mobile money charges. However, customer support is also an important factor in the overall value of MTN mobile money services. Good customer support can help users to resolve problems quickly and easily, which can save them time and money. Additionally, good customer support can help to build trust between MTN and its customers, which can lead to increased customer loyalty and retention.

MTN offers a variety of customer support channels, including:

- Phone support

- Email support

- Live chat support

- Social media support

- In-person support at MTN retail stores

The availability of multiple customer support channels is important for MTN Mobile Money users. This allows users to choose the channel that is most convenient for them. For example, users who are having trouble using the MTN Mobile Money app may prefer to call customer support for assistance. Users who have a quick question may prefer to use live chat support. And users who need to file a complaint may prefer to visit an MTN retail store in person.

Overall, customer support is an important part of MTN mobile money charges. By providing multiple customer support channels, MTN is able to meet the needs of its diverse customer base. This helps to ensure that MTN Mobile Money users have a positive experience and continue to use MTN's services.

Here is a table summarizing the key insights about the connection between customer support and MTN mobile money charges:

| Key Insight | Explanation |

|---|---|

| Customer support is an essential part of MTN mobile money charges. | The cost of providing customer support is passed on to users in the form of higher MTN mobile money charges. |

| Good customer support can help users to resolve problems quickly and easily, which can save them time and money. | Good customer support can also help to build trust between MTN and its customers, which can lead to increased customer loyalty and retention. |

| MTN offers a variety of customer support channels, including phone support, email support, live chat support, social media support, and in-person support at MTN retail stores. | The availability of multiple customer support channels is important for MTN Mobile Money users. This allows users to choose the channel that is most convenient for them. |

Legal and regulatory compliance

Legal and regulatory compliance is an important aspect of MTN mobile money charges. The laws and regulations that govern MTN Mobile Money are designed to protect consumers and ensure that MTN Mobile Money is operated in a safe and responsible manner.

- Consumer protection: The laws and regulations that govern MTN Mobile Money include provisions to protect consumers. For example, MTN Mobile Money is required to provide consumers with clear and concise information about its fees and charges. MTN Mobile Money is also required to have a dispute resolution process in place to resolve complaints from consumers.

- Anti-money laundering and counter-terrorism financing: The laws and regulations that govern MTN Mobile Money also include provisions to prevent money laundering and terrorist financing. For example, MTN Mobile Money is required to implement customer due diligence procedures to identify and verify its customers. MTN Mobile Money is also required to report suspicious transactions to the relevant authorities.

- Data protection: The laws and regulations that govern MTN Mobile Money also include provisions to protect consumer data. For example, MTN Mobile Money is required to implement measures to protect consumer data from unauthorized access and disclosure.

- Competition: The laws and regulations that govern MTN Mobile Money also include provisions to promote competition. For example, MTN Mobile Money is required to provide access to its network and services to other mobile money providers. MTN Mobile Money is also required to refrain from engaging in anti-competitive practices.

The laws and regulations that govern MTN Mobile Money have a significant impact on MTN mobile money charges. These laws and regulations help to ensure that MTN Mobile Money is operated in a safe, responsible, and competitive manner. This helps to protect consumers and promote confidence in MTN Mobile Money.

FAQs on MTN Mobile Money Charges

This section provides answers to frequently asked questions about MTN mobile money charges, offering clear and concise information to help you understand the associated costs.

Question 1: What are the different types of MTN mobile money charges?

MTN mobile money charges can vary depending on the type of transaction being conducted. Common charges include fees for sending money, withdrawing cash, paying bills, purchasing goods and services, and maintaining an account.

Question 2: How can I avoid MTN mobile money charges?

To minimize charges, consider using MTN mobile money services for essential transactions, keeping your account active to avoid inactivity fees, and exploring promotional offers or discounts provided by MTN.

Question 3: What factors influence MTN mobile money charges?

Charges can be affected by the amount of money being transacted, the type of transaction, the recipient's network, and regulatory requirements. Understanding these factors can help you plan and manage your mobile money expenses.

Question 4: How do I compare MTN mobile money charges with other providers?

To compare charges, research and compare fee structures, transaction limits, and any additional costs associated with using different mobile money providers. This allows you to make informed decisions based on your specific needs and usage patterns.

Question 5: What are the benefits of using MTN mobile money?

MTN mobile money offers convenience, security, and accessibility. It enables cashless transactions, reduces the risk of carrying physical cash, and provides a reliable platform for financial management and payments.

Question 6: How can I get support or assistance with MTN mobile money charges?

MTN provides multiple channels for support, including customer care hotlines, online platforms, and in-person assistance at service centers. You can reach out to MTN representatives for inquiries, clarifications, or assistance with any mobile money-related issues.

This concludes our frequently asked questions on MTN mobile money charges. Understanding these charges is crucial for effective budgeting, informed decision-making, and maximizing the benefits of MTN mobile money services.

Moving on to the next section...

Tips on MTN Mobile Money Charges

Understanding MTN mobile money charges is essential for effective budgeting and maximizing the benefits of the service. Here are some tips to help you manage your mobile money charges:

Tip 1: Familiarize yourself with the fee structure.

Review MTN's fee schedule to understand the charges associated with different types of transactions. This knowledge empowers you to make informed decisions about your mobile money usage.

Tip 2: Keep your account active.

Regularly using your MTN mobile money account helps you avoid inactivity fees. Maintaining an active account ensures that you can access your funds and conduct transactions without additional charges.

Tip 3: Utilize promotional offers and discounts.

MTN occasionally offers promotions and discounts on mobile money transactions. Take advantage of these opportunities to reduce your overall charges.

Tip 4: Compare charges with other providers.

Research and compare the charges of different mobile money providers to find the most cost-effective option that meets your specific needs.

Tip 5: Consolidate your transactions.

Instead of making multiple small transactions, consider consolidating them into fewer, larger transactions. This can help you save on transaction fees.

Tip 6: Use alternative payment methods for small transactions.

For small purchases or payments, consider using alternative methods like cash or debit cards to avoid mobile money transaction fees.

Tip 7: Monitor your transactions regularly.

Keep track of your mobile money transactions to identify any unauthorized or excessive charges. Promptly report any discrepancies to MTN for timely resolution.

Tip 8: Seek assistance when needed.

If you have any questions or concerns regarding MTN mobile money charges, don't hesitate to contact MTN's customer support channels for clarification and assistance.

These tips can help you effectively manage your MTN mobile money charges, optimize your usage, and enjoy the convenience and benefits of the service.

Conclusion

MTN mobile money charges are an integral part of using the service. Understanding these charges helps users make informed decisions about their mobile money usage and avoid unexpected expenses. This article has explored various aspects of MTN mobile money charges, including transaction fees, exchange rates, transaction limits, and more.

By familiarizing yourself with the fee structure, keeping your account active, and consolidating transactions, you can effectively manage your MTN mobile money charges. Additionally, staying informed about promotional offers and comparing charges with other providers can help you optimize your usage and enjoy the benefits of mobile money services without breaking the bank.

Article Recommendations