Unveil The Secrets: MTN Uganda Mobile Money Withdrawal Charges

MTN Uganda Mobile Money Withdrawal Charges refer to the fees levied by MTN Uganda, a telecommunications company in Uganda, for withdrawing funds from a mobile money account.

Understanding MTN Uganda Mobile Money withdrawal charges is crucial for individuals and businesses that rely on this platform for financial transactions. These charges vary depending on the withdrawal method and the amount being withdrawn. The charges are typically a percentage of the withdrawal amount, with minimum and maximum limits.

Withdrawing funds from a mobile money account is a convenient and widely used service in Uganda. It allows users to access their funds easily and make payments for goods and services. However, it's essential to be aware of the withdrawal charges to avoid unexpected expenses and make informed decisions when transacting.

MTN Uganda Mobile Money Withdrawal Charges

MTN Uganda Mobile Money withdrawal charges are fees levied for withdrawing funds from a mobile money account. Understanding these charges is crucial for effective financial management and budgeting.

- Amount: The withdrawal amount directly influences the charges levied.

- Method: Charges vary depending on the withdrawal method (e.g., agent, ATM).

- Network: MTN Uganda charges may differ from other mobile money networks.

- Location: Withdrawal charges might vary depending on the geographical location.

- Time: Charges may differ for withdrawals made during peak or off-peak hours.

- Taxes: Applicable taxes may be included in the withdrawal charges.

- Limits: MTN Uganda may impose minimum and maximum withdrawal limits.

- Convenience: The convenience of mobile money withdrawals comes with associated charges.

Considering these aspects, it's important to compare withdrawal charges across different methods and networks to choose the most cost-effective option. Additionally, planning withdrawals during off-peak hours or using methods with lower charges can help minimize expenses. Furthermore, understanding the impact of taxes and limits can prevent unexpected charges and ensure smooth transactions.

Amount

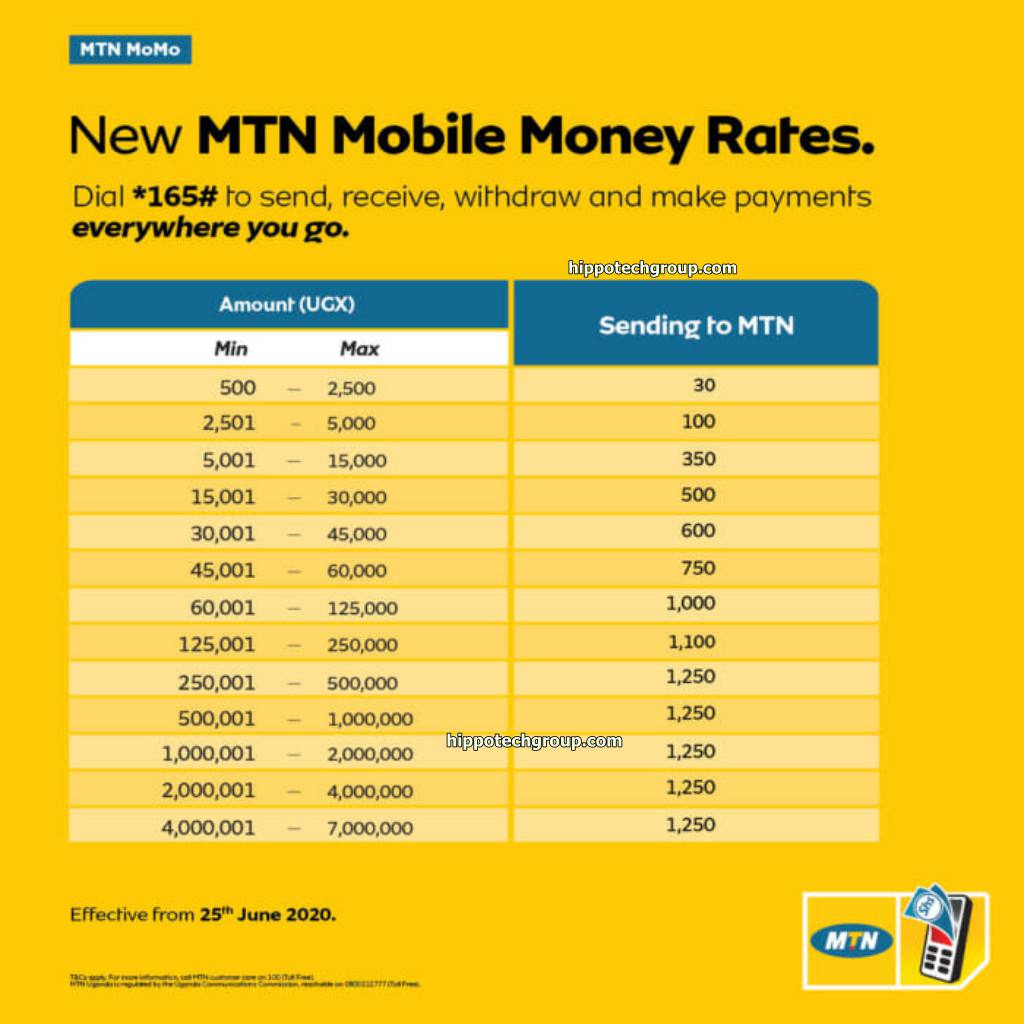

The withdrawal amount is a crucial factor that directly affects the charges levied for MTN Uganda mobile money withdrawals. As the withdrawal amount increases, so do the charges. This is because MTN Uganda charges a percentage-based fee on withdrawals, with higher percentages applied to larger amounts. Understanding this relationship is essential for budgeting and managing mobile money expenses effectively.

For instance, if the withdrawal charge is 1% and you withdraw 100,000 Ugandan shillings, you will be charged 1,000 shillings. However, if you withdraw 500,000 Ugandan shillings, the withdrawal charge will be 5,000 shillings. This linear relationship ensures that the charges are proportionate to the amount being withdrawn.

Therefore, when planning mobile money withdrawals, it's important to consider the withdrawal amount and the corresponding charges. By choosing to withdraw larger amounts less frequently, you can minimize the overall charges incurred compared to making multiple smaller withdrawals.

Method

The withdrawal method significantly influences the charges levied for MTN Uganda mobile money withdrawals. MTN Uganda offers various withdrawal methods, including agents, ATMs, and bank branches, each with its associated charges.

- Agents: Withdrawals through agents typically attract a higher charge compared to other methods. Agents are independent businesses that offer mobile money services, and they set their charges based on factors such as location and operating costs.

- ATMs: Withdrawing money from an ATM using a mobile money card usually incurs a lower charge compared to agents. Banks and mobile network operators determine these charges, and they may vary depending on the bank or network.

- Bank branches: Withdrawing mobile money from a bank branch often attracts the lowest charges. Banks have established relationships with mobile money operators, allowing for more favorable withdrawal rates.

Understanding the charges associated with each withdrawal method empowers users to make informed decisions. By choosing the most cost-effective method based on their needs and circumstances, users can minimize their mobile money withdrawal expenses.

Network

The charges levied for MTN Uganda mobile money withdrawals can vary in comparison to other mobile money networks operating in Uganda. This difference stems from several factors, including network-specific policies, operational costs, and competitive dynamics.

- Network Policies: Each mobile money network establishes its own set of charges for withdrawals based on their internal policies and strategies. These charges may vary depending on the network's market positioning, target customer base, and overall revenue model.

- Operational Costs: The costs incurred by each network in providing mobile money services, such as maintaining infrastructure, processing transactions, and managing agents, can influence withdrawal charges. Networks with higher operational costs may pass on these expenses to customers through higher withdrawal fees.

- Competitive Dynamics: The competitive landscape of the mobile money market in Uganda plays a role in shaping withdrawal charges. Networks may adjust their charges to attract or retain customers, offering competitive rates or promotions to gain market share.

Understanding the potential differences in withdrawal charges across mobile money networks is crucial for users seeking the most cost-effective and convenient option. By comparing charges and considering factors such as network coverage, transaction limits, and agent availability, users can make informed decisions when choosing a mobile money network that aligns with their financial needs.

Location

The geographical location of a mobile money withdrawal transaction can influence the charges levied by MTN Uganda. This is attributed to several key factors:

- Regional Operating Costs: The costs associated with providing mobile money services, such as agent commissions, network maintenance, and regulatory compliance, can vary across different regions of Uganda. These variations in operating costs are often reflected in the withdrawal charges.

- Agent Availability: The density and accessibility of MTN Uganda mobile money agents in a particular location can impact withdrawal charges. In areas with fewer agents, MTN Uganda may need to incentivize agents to offer their services, which can lead to higher withdrawal charges.

- Economic Conditions: The overall economic conditions of a region can also influence withdrawal charges. In areas with lower economic activity, MTN Uganda may adjust charges to cater to the lower spending capacity of customers.

Understanding the potential variations in withdrawal charges based on location can assist users in making informed decisions when transacting. By considering the regional factors that may affect charges, users can identify the most cost-effective options for their mobile money withdrawals.

Time

The timing of a mobile money withdrawal transaction can affect the charges levied by MTN Uganda. This is primarily due to fluctuations in network traffic and operational costs during different times of the day.

- Peak Hours: During peak hours, when network traffic is high (typically during morning and evening hours), MTN Uganda may impose higher withdrawal charges to manage the surge in transactions and maintain network stability.

- Off-Peak Hours: Conversely, during off-peak hours (typically late at night and early morning), when network traffic is lower, MTN Uganda may offer lower withdrawal charges to encourage transactions and optimize network utilization.

Understanding the relationship between time and withdrawal charges allows users to plan their transactions strategically. By making withdrawals during off-peak hours, users can potentially save money on charges compared to withdrawing during peak hours.

Taxes

Understanding the connection between taxes and MTN Uganda mobile money withdrawal charges is crucial for accurate budgeting and financial planning. Taxes levied on mobile money transactions can directly impact the overall cost of withdrawals.

- Value Added Tax (VAT): VAT is a consumption tax levied on the sale of goods and services, including mobile money transactions. In Uganda, the standard VAT rate is 18%. MTN Uganda is required to charge VAT on its mobile money withdrawal services, which is then remitted to the Uganda Revenue Authority (URA).

- Withholding Tax: Withholding tax is a tax deducted from certain types of payments, including mobile money withdrawals. The withholding tax rate in Uganda is 10%. MTN Uganda may deduct withholding tax from mobile money withdrawals exceeding a certain threshold, and this amount is remitted to the URA.

The inclusion of taxes in MTN Uganda mobile money withdrawal charges can increase the overall cost of withdrawals. It is important for users to be aware of these taxes and factor them into their financial calculations to avoid unexpected expenses.

Limits

Withdrawal limits are a crucial aspect of MTN Uganda's mobile money services, directly impacting the user's ability to access and manage their funds. These limits are established to maintain financial stability, prevent fraud, and comply with regulatory requirements.

- Minimum Withdrawal Limit: MTN Uganda may impose a minimum withdrawal limit to discourage excessively small withdrawals that could strain the system and increase operational costs.

- Maximum Withdrawal Limit: A maximum withdrawal limit is set to manage risk, prevent money laundering, and comply with anti-money laundering regulations.

- Daily Withdrawal Limit: MTN Uganda may implement a daily withdrawal limit to control the total amount of money that can be withdrawn within a 24-hour period.

- Cumulative Withdrawal Limit: This limit restricts the total amount that can be withdrawn over a specified period, such as a month, to further enhance financial security.

Understanding these withdrawal limits is essential for effective mobile money management. Users should be aware of the limits to avoid exceeding them and incurring potential penalties or delays in accessing their funds.

Convenience

The convenience offered by mobile money withdrawals is undeniable. It allows users to access their funds and make payments anytime, anywhere, without the need for physical cash. However, this convenience comes with associated charges levied by MTN Uganda, which users must be aware of to make informed financial decisions.

The charges for mobile money withdrawals vary depending on factors such as the withdrawal amount, method, and location. Understanding these charges is crucial for budgeting and managing expenses effectively. By considering the charges associated with different withdrawal options, users can choose the most cost-effective method that meets their needs.

For instance, withdrawing large amounts of money may incur higher charges compared to smaller withdrawals. Similarly, using an agent for withdrawal may attract a higher charge than withdrawing directly from an ATM. By understanding these variations, users can optimize their withdrawals to minimize charges and maximize convenience.

FAQs on MTN Uganda Mobile Money Withdrawal Charges

This section provides answers to frequently asked questions regarding MTN Uganda mobile money withdrawal charges.

Question 1: What factors influence MTN Uganda mobile money withdrawal charges?

Answer: MTN Uganda mobile money withdrawal charges are determined by several factors, including the withdrawal amount, withdrawal method (agent, ATM, bank branch), and location of the withdrawal.

Question 2: Are there any minimum or maximum withdrawal limits?

Answer: Yes, MTN Uganda imposes minimum and maximum withdrawal limits to manage financial stability, prevent fraud, and comply with regulatory requirements.

Question 3: How can I minimize withdrawal charges?

Answer: To minimize withdrawal charges, consider withdrawing larger amounts less frequently, choosing lower-cost withdrawal methods (such as bank branches or ATMs), and making withdrawals during off-peak hours.

Question 4: Are there any additional charges besides withdrawal fees?

Answer: Applicable taxes, such as Value Added Tax (VAT) and Withholding Tax, may be included in the withdrawal charges.

Question 5: What should I do if I encounter an issue with withdrawal charges?

Answer: Contact MTN Uganda customer care or visit an MTN service center for assistance with any issues or inquiries related to withdrawal charges.

Question 6: How can I stay updated on changes to withdrawal charges?

Answer: Regularly check MTN Uganda's official website, social media channels, or contact customer care for the latest information on withdrawal charges and any applicable changes.

Summary: Understanding MTN Uganda mobile money withdrawal charges is essential for effective financial management. By considering the factors that influence charges and making informed decisions, users can optimize their withdrawals to minimize expenses and maximize convenience.

Transition to the next article section: For further inquiries or assistance with MTN Uganda mobile money services, kindly visit the MTN Uganda website or contact customer care.

Tips on MTN Uganda Mobile Money Withdrawal Charges

Understanding and managing MTN Uganda mobile money withdrawal charges is crucial for optimizing your financial transactions. Here are some practical tips to help you minimize charges and maximize convenience:

Tip 1: Choose Cost-Effective Withdrawal Methods

Consider using lower-cost withdrawal methods such as bank branches or ATMs instead of agents, as agents typically charge higher fees.

Tip 2: Plan Withdrawals During Off-Peak Hours

MTN Uganda may charge higher fees for withdrawals made during peak hours. Plan your withdrawals during off-peak hours (typically late at night or early morning) to potentially save on charges.

Tip 3: Withdraw Larger Amounts Less Frequently

Withdrawing larger amounts less frequently can help reduce overall charges compared to making multiple smaller withdrawals.

Tip 4: Be Aware of Withdrawal Limits

MTN Uganda imposes minimum and maximum withdrawal limits. Familiarize yourself with these limits to avoid exceeding them and incurring additional charges or delays.

Tip 5: Track Your Withdrawals

Keep track of your mobile money withdrawals to monitor your expenses and identify areas where you can save on charges.

Tip 6: Contact Customer Care for Assistance

If you encounter any issues or have questions related to withdrawal charges, do not hesitate to contact MTN Uganda customer care for assistance.

Summary: By following these tips, you can effectively manage MTN Uganda mobile money withdrawal charges, optimize your financial transactions, and maximize the convenience of mobile money services.

Transition to the article's conclusion: MTN Uganda's mobile money services offer a convenient and secure way to manage your finances. Understanding and managing withdrawal charges is a key aspect of maximizing the benefits of these services.

Conclusion

Understanding "MTN Uganda Mobile Money Withdrawal Charges" is crucial for managing your financial transactions effectively. This article has explored the various factors that influence these charges, including withdrawal amount, method, location, and time. It has also provided practical tips to help you minimize charges and maximize convenience.

By following the tips outlined in this article, you can make informed decisions about your mobile money withdrawals and optimize your financial management. MTN Uganda's mobile money services offer a convenient and secure way to manage your finances, and understanding withdrawal charges is a key aspect of maximizing the benefits of these services.

Article Recommendations