Unlock The Secrets Of MTN Mobile Money Charges In Uganda 2024

MTN Mobile Money Charges in Uganda 2024 refer to the fees associated with using MTN's mobile money services in Uganda during the year 2024.

Understanding these charges is crucial for individuals and businesses that rely on MTN's mobile money platform for financial transactions. The charges cover various services, including sending and receiving money, airtime purchases, bill payments, and merchant payments.

MTN Mobile Money has gained widespread popularity in Uganda due to its convenience, security, and affordability. The charges are designed to sustain the service's operations while ensuring accessibility and value for customers.

The specific charges may vary depending on factors such as the transaction amount, transaction type, and customer's subscription plan. It is recommended to consult MTN's official website or contact their customer care for the most up-to-date information on charges.

MTN Mobile Money Charges in Uganda 2024

Understanding the various aspects of MTN Mobile Money charges in Uganda for 2024 is crucial for effective utilization of this financial service. Here are 9 key aspects to consider:

- Transaction Fees

- Airtime Purchase Charges

- Bill Payment Costs

- Merchant Payment Fees

- Currency Conversion Rates

- Minimum and Maximum Limits

- Subscription Plans

- Taxes and Levies

- Promotional Offers

These aspects encompass the different dimensions related to MTN Mobile Money charges, including the costs associated with sending and receiving money, purchasing airtime, paying bills, making merchant payments, and currency conversions. Understanding these charges allows users to plan their transactions effectively, manage their finances, and take advantage of any available promotional offers.

Transaction Fees

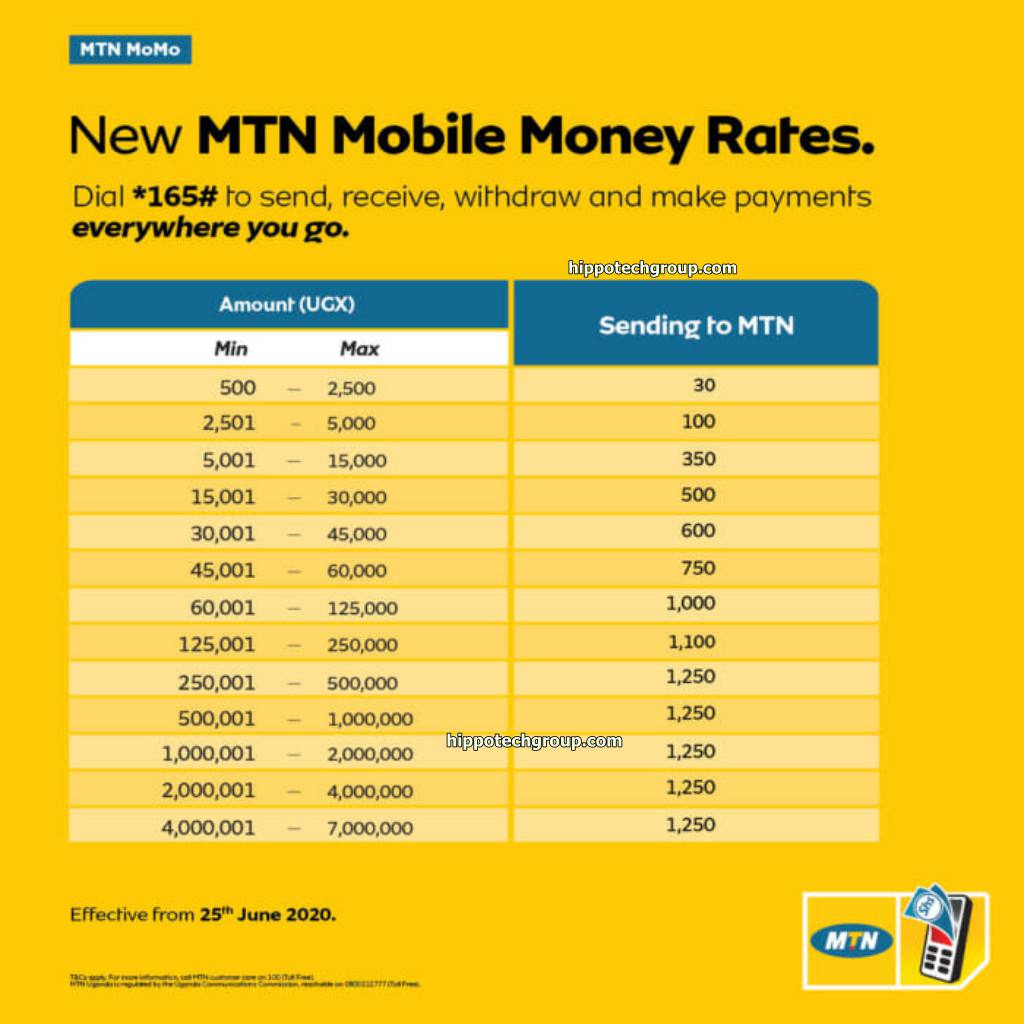

Transaction fees are an essential component of MTN Mobile Money charges in Uganda for 2024. These fees are levied on various types of transactions conducted through the MTN Mobile Money platform, including sending and receiving money, airtime purchases, bill payments, and merchant payments.

The specific transaction fees vary depending on the transaction amount, transaction type, and the customer's subscription plan. A clear understanding of these fees is crucial for users to effectively manage their finances and plan their transactions.

For instance, if a customer wishes to send 100,000 Ugandan shillings to another MTN Mobile Money user, they will incur a transaction fee of 1,500 Ugandan shillings. This fee covers the cost of processing the transaction and maintaining the platform's infrastructure.

Understanding transaction fees is also important for businesses that utilize MTN Mobile Money for merchant payments. Businesses need to factor these fees into their pricing strategies to ensure they remain competitive and profitable.

Airtime Purchase Charges

Airtime purchase charges form an integral part of MTN Mobile Money charges in Uganda for 2024. These charges refer to the fees incurred when users purchase airtime or data bundles for their mobile phones using the MTN Mobile Money platform.

Airtime purchase charges are significant for several reasons. Firstly, they contribute to MTN's revenue generation, enabling the company to maintain and improve its network infrastructure and services. Secondly, these charges provide a convenient and accessible way for users to top up their airtime balance, ensuring they can stay connected with friends, family, and business associates.

The specific airtime purchase charges vary depending on the amount of airtime or data purchased. For instance, purchasing 10,000 Ugandan shillings worth of airtime may attract a charge of 500 Ugandan shillings. It is important for users to be aware of these charges to effectively manage their mobile expenses.

Understanding airtime purchase charges is also crucial for businesses that utilize MTN Mobile Money for merchant payments. Businesses can incorporate these charges into their pricing strategies to ensure they remain competitive and profitable.

Bill Payment Costs

Bill payment costs are an essential aspect of MTN Mobile Money charges in Uganda for 2024. These costs refer to the fees associated with paying various types of bills, such as utility bills, tuition fees, and government levies, through the MTN Mobile Money platform.

- Transaction Fees: Bill payment transactions through MTN Mobile Money incur a transaction fee, which varies depending on the amount and type of bill being paid. Understanding these fees helps users plan their transactions effectively and budget accordingly.

- Convenience and Accessibility: MTN Mobile Money provides a convenient and accessible way for users to pay their bills from the comfort of their homes or on the go. This eliminates the need for physically visiting bill payment offices, saving time and effort.

- Security and Reliability: MTN Mobile Money offers a secure and reliable platform for bill payments, ensuring that transactions are processed safely and efficiently. This gives users peace of mind and reduces the risk of fraud or errors.

- Merchant Partnerships: MTN has partnered with various billers, including utility companies, educational institutions, and government agencies, to facilitate seamless bill payments. These partnerships ensure a wide range of bill payment options for users.

Understanding bill payment costs and the benefits associated with MTN Mobile Money is crucial for effective financial management and planning. Users can leverage the convenience, security, and accessibility of MTN Mobile Money to streamline their bill payment process.

Merchant Payment Fees

Merchant payment fees are a crucial component of MTN mobile money charges in Uganda for 2024, representing the fees charged to businesses for accepting MTN Mobile Money as a payment method. These fees play a significant role in the overall cost structure of businesses, impacting their profitability and financial planning.

The importance of understanding merchant payment fees lies in their direct impact on business operations. Businesses need to carefully consider these fees when setting their pricing strategies and evaluating the viability of accepting MTN Mobile Money. Higher merchant fees can reduce profit margins and make it challenging for businesses to compete effectively.

For instance, a business that sells products worth 100,000 Ugandan shillings may incur a merchant fee of 3,000 Ugandan shillings for a single transaction. While this may seem like a small amount, it can accumulate over time, especially for businesses with high transaction volumes. Businesses need to factor these fees into their pricing to ensure they remain profitable.

Moreover, understanding merchant payment fees is crucial for effective financial planning and budgeting. Businesses can forecast their expenses related to MTN Mobile Money transactions and make informed decisions about resource allocation. This understanding helps businesses optimize their cash flow and reduce the risk of financial surprises.

Currency Conversion Rates

Currency conversion rates play a significant role in MTN mobile money charges in Uganda for 2024. When a user sends or receives money internationally, the transaction involves currency conversion, which incurs a conversion fee. Understanding these rates and their impact is crucial for effective financial planning and budgeting.

MTN mobile money charges in Uganda for 2024 include a currency conversion fee that varies depending on the currencies involved and the prevailing market rates. These fees can accumulate, especially for frequent international transactions or large amounts. For instance, if a user sends 100,000 Ugandan shillings to a recipient in Kenya, the transaction may incur a conversion fee of 3,000 Ugandan shillings, based on the current exchange rate.

Understanding currency conversion rates is essential for businesses and individuals who engage in international transactions using MTN mobile money. Businesses need to factor these rates into their pricing strategies to ensure they remain competitive and profitable. Individuals should also be aware of these rates to make informed decisions when sending or receiving money internationally, as they can impact the overall cost of the transaction.

Minimum and Maximum Limits

Minimum and maximum limits are crucial aspects of MTN mobile money charges in Uganda for 2024. These limits define the boundaries within which users can transact using the platform, ensuring financial stability and responsible usage.

- Transaction Limits: MTN sets minimum and maximum limits for transactions, including sending, receiving, and withdrawing money. These limits help prevent fraud, protect users from overspending, and maintain the overall integrity of the platform.

- Account Balance Limits: MTN also imposes minimum and maximum limits on the amount of money that users can hold in their mobile money accounts. These limits safeguard users from potential losses in case of unauthorized access or security breaches.

- Daily Transaction Volume Limits: To curb excessive usage and potential abuse, MTN establishes daily transaction volume limits for users. These limits restrict the number of transactions a user can perform within a specific period, preventing excessive strain on the platform and promoting fair usage.

- Cumulative Transaction Value Limits: MTN sets cumulative transaction value limits to monitor and regulate the total value of transactions conducted over a certain period. These limits help identify and prevent suspicious activities, ensuring the platform's security and stability.

Understanding minimum and maximum limits is essential for effective use of MTN mobile money services. Users should familiarize themselves with these limits to avoid potential disruptions or limitations in their transactions. Adhering to these limits contributes to the overall security, integrity, and responsible usage of the MTN mobile money platform.

Subscription Plans

Subscription plans play a crucial role in determining mtn mobile money charges in Uganda for 2024. These plans offer users a variety of benefits and features, each with its own set of associated charges.

- Basic Plan: The basic plan is typically the most affordable option and includes a limited set of features. Users on this plan may incur lower transaction fees and maintenance charges compared to other plans.

- Standard Plan: The standard plan offers a wider range of features and benefits, such as higher transaction limits and access to exclusive promotions. These added features come with a higher monthly or annual subscription fee.

- Premium Plan: The premium plan is the most comprehensive option and includes the highest level of features and benefits. Users on this plan enjoy the lowest transaction fees, priority customer support, and access to exclusive rewards programs.

- Corporate Plan: The corporate plan is tailored for businesses and organizations. It offers customized features and benefits, such as bulk transaction capabilities, dedicated account management, and tailored pricing options.

Understanding the different subscription plans and their associated charges is essential for users to optimize their mtn mobile money experience. By choosing the plan that best aligns with their usage patterns and financial needs, users can effectively manage their mobile money expenses and maximize the value they derive from the service.

Taxes and Levies

Taxes and levies form an integral part of MTN mobile money charges in Uganda for 2024. These are mandatory contributions imposed by the government on various financial transactions, including mobile money transactions, to generate revenue and support public services.

- Value Added Tax (VAT): VAT is a consumption tax levied on the sale of goods and services, including mobile money transactions. In Uganda, the standard VAT rate is 18%, which is applied to the transaction amount when sending or receiving money via MTN mobile money.

- Withholding Tax: Withholding tax is a tax deducted at source on payments made for certain services, including mobile money withdrawals. In Uganda, the withholding tax rate for mobile money withdrawals is 10%, which is deducted from the withdrawal amount.

- Transaction Levy: The transaction levy is a specific tax imposed on mobile money transactions in Uganda. It is a fixed amount charged per transaction, regardless of the transaction value. The current transaction levy rate is 0.5%, capped at UGX 10,000 per transaction.

- Agent Commission Tax: MTN mobile money agents earn commissions on transactions they facilitate. These commissions are subject to income tax, which is deducted at source by MTN and remitted to the Uganda Revenue Authority (URA).

Understanding taxes and levies associated with MTN mobile money charges in Uganda for 2024 is crucial for users to accurately calculate transaction costs and plan their financial activities effectively. These taxes and levies contribute to government revenue, which is utilized to fund essential public services and infrastructure development.

Promotional Offers

Promotional offers form a strategic component of MTN mobile money charges in Uganda for 2024. These offers are designed to attract new customers, reward existing ones, and drive usage of the platform. Understanding the various types of promotional offers and their implications is crucial for users to optimize their mobile money experience and maximize the value they derive from the service.

- Free Transactions: MTN often runs promotions that offer free transactions for a limited period. These promotions encourage users to try the service or increase their usage, as they can send or receive money without incurring any transaction fees.

- Discounted Transactions: MTN may offer discounts on transaction fees during specific periods or for certain types of transactions. These discounts make mobile money transactions more affordable, incentivizing users to use the platform for their financial needs.

- Cashback and Rewards: MTN rewards users for their loyalty and usage through cashback and rewards programs. Users can earn points or cashback on their transactions, which can be redeemed for various benefits, such as airtime, data bundles, or discounts on partner services.

- Exclusive Promotions for Special Groups: MTN offers exclusive promotions tailored to specific groups of users, such as students, teachers, or government employees. These promotions provide these groups with customized benefits and incentives to encourage mobile money adoption and usage.

Promotional offers play a significant role in shaping MTN mobile money charges in Uganda for 2024. By understanding the different types of offers available and their terms and conditions, users can take advantage of these promotions to reduce their transaction costs, earn rewards, and enjoy a more cost-effective mobile money experience.

FAQs on MTN Mobile Money Charges in Uganda 2024

This section addresses frequently asked questions (FAQs) regarding MTN mobile money charges in Uganda for 2024. Understanding these charges is crucial for effective financial planning and budgeting.

Question 1: What factors influence MTN mobile money charges?

Answer: MTN mobile money charges vary based on factors such as transaction amount, transaction type, customer's subscription plan, and applicable taxes and levies.

Question 2: How can I minimize MTN mobile money charges?

Answer: Utilizing promotional offers, choosing a suitable subscription plan, and being aware of transaction limits and fees can help reduce mobile money charges.

Question 3: Are there any hidden charges associated with MTN mobile money?

Answer: No, MTN discloses all applicable charges transparently. Users can refer to the official MTN website or contact customer care for detailed information on charges.

Question 4: How do I stay updated on changes to MTN mobile money charges?

Answer: MTN typically announces any changes to its mobile money charges through official channels such as SMS, email, and the company website.

Question 5: What are the benefits of using MTN mobile money?

Answer: MTN mobile money offers convenience, security, and accessibility for financial transactions. It eliminates the need for physical cash, reduces the risk of theft, and facilitates easy bill payments and money transfers.

Question 6: How can I get assistance with MTN mobile money charges?

Answer: MTN provides multiple channels for assistance, including customer care hotlines, live chat support, and comprehensive FAQs on their website.

Summary: Understanding MTN mobile money charges in Uganda for 2024 is essential for effective financial management. By being aware of the various factors that influence these charges, users can make informed decisions and take advantage of available cost-saving measures.

Transition: For further insights into MTN mobile money services, including registration, transaction limits, and security measures, please explore the following sections.

Tips on MTN Mobile Money Charges in Uganda 2024

To optimize the use of MTN mobile money services and minimize associated charges in Uganda for 2024, consider the following tips:

Tip 1: Choose the Right Subscription Plan: MTN offers various subscription plans tailored to different usage patterns and financial needs. Selecting a plan that aligns with your transaction volume and frequency can help reduce overall charges.

Tip 2: Take Advantage of Promotional Offers: MTN frequently introduces promotional offers, such as free or discounted transactions, cashback, and rewards. Utilizing these offers can significantly lower your mobile money expenses.

Tip 3: Utilize MTN Mobile Money Agents: MTN mobile money agents provide convenient access to cash-in and cash-out services. While agents may charge a small commission, it can be more cost-effective than using bank branches or ATMs, especially for small transactions.

Tip 4: Send Money in Bulk: If you need to send multiple payments, consider using the bulk transfer feature. This option allows you to send money to several recipients at once, potentially reducing transaction fees compared to sending each payment individually.

Tip 5: Be Aware of Transaction Limits: MTN imposes transaction limits to prevent fraud and ensure financial stability. Understanding these limits and planning your transactions accordingly can avoid exceeding limits and incurring additional charges.

Summary: By following these tips, users can effectively manage MTN mobile money charges in Uganda for 2024. Choosing the right subscription plan, taking advantage of promotional offers, utilizing MTN mobile money agents, sending money in bulk, and being aware of transaction limits can help optimize your mobile money usage and save on associated costs.

Transition: Understanding MTN mobile money charges is crucial for effective financial planning. This article has provided comprehensive insights into these charges, their implications, and strategies to minimize expenses. By applying the tips outlined above, users can make informed decisions and fully leverage the benefits of MTN mobile money services.

Conclusion

Understanding MTN mobile money charges in Uganda for 2024 is essential for effective financial planning and management. This article has comprehensively explored these charges, covering various aspects such as transaction fees, airtime purchase charges, bill payment costs, merchant payment fees, currency conversion rates, minimum and maximum limits, subscription plans, taxes and levies, and promotional offers.

By staying informed about these charges and implementing the tips provided, users can optimize their mobile money usage, minimize expenses, and fully leverage the benefits of this convenient and secure financial service. MTN's commitment to transparency and customer-centricity ensures that users have access to clear information on charges and can make informed decisions when using the platform.

Article Recommendations