Uncover Hidden Costs: The Ultimate Guide To MTN Uganda Withdrawal Charges

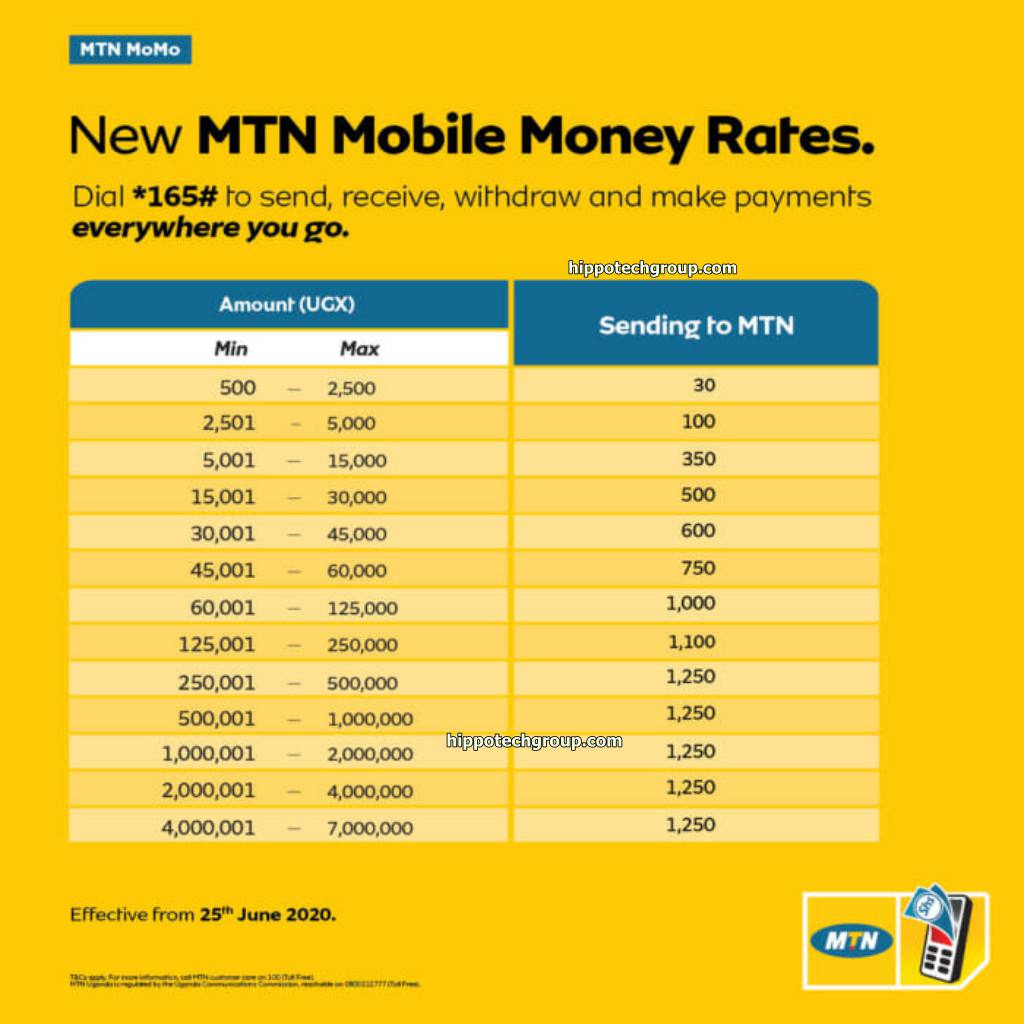

Transaction fees levied by MTN Uganda for cash withdrawals.

When withdrawing money from MTN Mobile Money in Uganda, charges may apply depending on the transaction amount and withdrawal method. These charges are known as withdrawal fees. Understanding these fees is crucial for budgeting and managing your financial transactions.

MTN Uganda offers various withdrawal options, including ATM withdrawals, agent withdrawals, and bank withdrawals. Each method may have different withdrawal charges. Additionally, the amount being withdrawn may also impact the fee charged. Generally, larger withdrawal amounts may attract higher fees.

What are the Withdrawal Charges for MTN Uganda

Understanding the withdrawal charges levied by MTN Uganda is essential for managing your Mobile Money transactions effectively. Here are ten key aspects to consider:

- Transaction amount: The amount being withdrawn influences the withdrawal fee.

- Withdrawal method: ATM withdrawals, agent withdrawals, and bank withdrawals have varying charges.

- Transaction fees: MTN charges a service fee for every withdrawal transaction.

- Network fees: Additional fees may apply for withdrawals made on other networks.

- Withdrawal limits: MTN Uganda imposes daily and monthly withdrawal limits.

- Transaction reversals: Reversing a withdrawal may incur additional charges.

- Transaction errors: Failed or declined withdrawals may still attract a fee.

- Float balance: Insufficient funds in your MTN Mobile Money account can result in failed transactions and potential charges.

- Promotional offers: MTN may offer promotions or discounts on withdrawal fees from time to time.

- Customer support: Contacting MTN customer care for assistance with withdrawal charges or related issues may incur a fee.

These aspects highlight the importance of being aware of the withdrawal charges associated with MTN Mobile Money in Uganda. By understanding these charges, you can make informed decisions about your transactions, budget effectively, and avoid unexpected expenses.

Transaction amount

The transaction amount plays a crucial role in determining the withdrawal fee charged by MTN Uganda. As the amount being withdrawn increases, the withdrawal fee also tends to increase. This is because MTN Uganda charges a percentage-based fee on withdrawals, and larger withdrawals result in a higher fee. Understanding this relationship is essential for budgeting and managing your financial transactions effectively.

For example, if the withdrawal fee is 1% and you withdraw UGX 100,000, the withdrawal fee will be UGX 1,000. However, if you withdraw UGX 500,000, the withdrawal fee will be UGX 5,000. Therefore, it is important to consider the withdrawal fee when making large withdrawals to avoid unexpected expenses.

In conclusion, the transaction amount is a significant factor in determining the withdrawal charges for MTN Uganda. By understanding this relationship, you can make informed decisions about your transactions and manage your Mobile Money account effectively.

Withdrawal method

The withdrawal method you choose when accessing your MTN Mobile Money in Uganda directly influences the charges you incur. MTN Uganda offers three primary withdrawal methods: ATM withdrawals, agent withdrawals, and bank withdrawals. Each method has its own unique fee structure, and understanding these differences is crucial for optimizing your financial transactions.

- ATM withdrawals: When withdrawing money from an ATM using your MTN Mobile Money account, you will be charged a withdrawal fee. The fee varies depending on the amount being withdrawn and the specific ATM network used. ATM withdrawals generally attract higher fees compared to other withdrawal methods.

- Agent withdrawals: MTN Uganda has a wide network of agents across the country where you can withdraw money from your Mobile Money account. Agent withdrawals typically have lower fees compared to ATM withdrawals. However, the fee may vary depending on the agent's location and the amount being withdrawn.

- Bank withdrawals: Withdrawing money from your MTN Mobile Money account through a bank may also incur a fee. The fee structure varies depending on the bank and the amount being withdrawn. It is important to check with your bank for their specific charges before making a withdrawal.

By understanding the varying charges associated with each withdrawal method, you can make informed decisions about how to access your MTN Mobile Money funds. Choosing the most cost-effective method based on your needs can help you save money and manage your finances efficiently.

Transaction fees

The transaction fee charged by MTN Uganda for every withdrawal transaction is a fundamental component of the overall withdrawal charges you incur when accessing your Mobile Money funds. This fee is levied as a service charge for the convenience of withdrawing money from your MTN Mobile Money account. Understanding the significance of transaction fees is crucial for managing your finances effectively and avoiding unexpected expenses.

The transaction fee is typically a fixed amount or a percentage of the withdrawal amount, depending on the withdrawal method used. For instance, ATM withdrawals may attract a higher transaction fee compared to agent withdrawals. Additionally, the transaction fee may vary based on the network or bank involved in the transaction.

By being aware of the transaction fees associated with MTN Mobile Money withdrawals, you can make informed decisions about your financial transactions. Choosing the most cost-effective withdrawal method and budgeting for the transaction fees can help you optimize your financial management and avoid unnecessary expenses.

Network fees

Understanding network fees is crucial when considering the overall withdrawal charges for MTN Uganda, as they can add to the total cost of your transaction. Network fees are additional charges that may apply when you withdraw money from your MTN Mobile Money account using a network other than MTN's. This scenario often occurs when withdrawing from an ATM or agent that is not operated by MTN.

- Inter-network fees: When making a withdrawal from an ATM or agent that belongs to a different network, MTN Uganda may charge an inter-network fee. This fee compensates the other network for facilitating the transaction. The inter-network fee is typically a fixed amount and varies depending on the network involved.

- Cross-border fees: If you are withdrawing money from your MTN Mobile Money account while roaming in another country, you may incur cross-border fees. These fees cover the costs associated with transferring funds across international networks. Cross-border fees can vary depending on the country you are visiting and the network you are using.

Being aware of network fees is essential for budgeting and managing your financial transactions effectively. By understanding the potential charges involved when withdrawing from other networks, you can make informed decisions and choose the most cost-effective withdrawal method for your needs.

Withdrawal limits

Withdrawal limits play a crucial role in understanding the overall withdrawal charges levied by MTN Uganda. These limits determine the maximum amount of money you can withdraw from your MTN Mobile Money account within a specific timeframe, typically daily and monthly. Understanding these limits is essential for effective financial management and avoiding potential penalties or failed transactions.

MTN Uganda imposes daily withdrawal limits to manage the flow of money and prevent excessive withdrawals. Exceeding the daily limit may result in additional charges or declined transactions. Monthly withdrawal limits are also implemented to ensure responsible financial behavior and prevent overspending.

The withdrawal limits set by MTN Uganda serve as a protective measure for both the user and the service provider. By adhering to these limits, you can avoid incurring unnecessary charges and maintain control over your financial transactions. Monitoring your withdrawals and staying within the established limits is essential for managing your MTN Mobile Money account effectively.

Transaction reversals

Understanding the implications of transaction reversals is essential when considering "what are the withdrawal charges for MTN Uganda." A transaction reversal occurs when a withdrawal is canceled or reversed after it has been initiated. This can happen due to various reasons, such as incorrect transaction details, failed transactions, or disputes. It is important to be aware that reversing a withdrawal may incur additional charges.

MTN Uganda charges a reversal fee to cover the administrative and operational costs associated with reversing a withdrawal. This fee is typically a fixed amount and is added to the original withdrawal charges. The reversal fee serves as a deterrent against frivolous or fraudulent reversals and helps maintain the integrity of the Mobile Money platform.

The practical significance of understanding transaction reversal charges lies in its impact on financial management. By being aware of these charges, users can make informed decisions about whether to proceed with a reversal or explore alternative solutions. Additionally, it helps users budget accurately and avoid unexpected expenses.

Transaction errors

Understanding the connection between transaction errors and withdrawal charges is crucial when exploring "what are the withdrawal charges for MTN Uganda." Transaction errors refer to instances where a withdrawal is attempted but fails or is declined due to various reasons. Despite the withdrawal being unsuccessful, MTN Uganda may still charge a fee for the attempted transaction.

These charges are typically levied to cover the operational and administrative costs associated with processing the withdrawal request, even if it was unsuccessful. The fee serves as a deterrent against frivolous or fraudulent withdrawal attempts and helps maintain the integrity of the Mobile Money platform.

The practical significance of this understanding lies in its impact on financial management and budgeting. By being aware of the potential charges associated with transaction errors, users can make informed decisions about whether to proceed with a withdrawal or explore alternative solutions. This knowledge helps avoid unexpected expenses and ensures accurate budgeting.

In conclusion, understanding the connection between transaction errors and withdrawal charges is essential for effective financial management when using MTN Mobile Money in Uganda. It empowers users to make informed decisions, avoid unnecessary charges, and maintain control over their financial transactions.

Float balance

Understanding the connection between float balance and withdrawal charges is crucial when examining "what are the withdrawal charges for MTN Uganda." Float balance refers to the available balance in your MTN Mobile Money account. Insufficient funds in your account can lead to failed transactions and potential charges.

When you initiate a withdrawal, MTN Uganda checks if you have sufficient funds in your account to cover the withdrawal amount and any applicable charges. If your float balance is insufficient, the transaction will fail, and you may incur a failed transaction fee. This fee serves as a deterrent against overdraft withdrawals and helps maintain the integrity of the Mobile Money platform.

The practical significance of understanding this connection lies in its impact on financial management. By being aware of the potential charges associated with insufficient float balance, users can avoid failed transactions and unnecessary expenses. It also emphasizes the importance of maintaining a positive float balance to ensure smooth and successful withdrawals.

In conclusion, understanding the connection between float balance and withdrawal charges is essential for effective financial management when using MTN Mobile Money in Uganda. It empowers users to make informed decisions, avoid failed transactions, and maintain control over their financial resources.

Promotional offers

When examining "what are the withdrawal charges for MTN Uganda," it is essential to consider promotional offers and discounts. MTN Uganda occasionally introduces promotions or discounts on withdrawal fees as part of their marketing strategies and customer loyalty programs. These offers can significantly impact the overall withdrawal charges incurred by users.

Promotional offers can take various forms, such as reduced withdrawal fees during specific time periods, discounts for high-value withdrawals, or loyalty rewards for frequent users. Understanding these promotions can help users optimize their financial transactions and save money on withdrawal charges.

The practical significance of this understanding lies in its impact on financial management. By being aware of promotional offers, users can plan their withdrawals accordingly and take advantage of cost-saving opportunities. It empowers them to make informed decisions and maximize the value of their MTN Mobile Money accounts.

In conclusion, exploring the connection between promotional offers and withdrawal charges is crucial for effective financial management when using MTN Mobile Money in Uganda. It highlights the importance of staying informed about promotions and discounts to optimize transactions, reduce costs, and enhance the overall user experience.

Customer support

Exploring the connection between customer support and withdrawal charges in MTN Uganda's Mobile Money services reveals important considerations for users.

MTN Uganda offers customer support channels to assist users with various inquiries and issues related to their Mobile Money accounts, including withdrawal charges. While accessing customer support is generally free, specific services or assistance may incur a fee.

Understanding the potential charges associated with contacting customer support is crucial for effective financial management. Users should be aware of the cost implications before reaching out to customer care for assistance with withdrawal charges or related matters.

The practical significance of this understanding lies in empowering users to make informed decisions. By being aware of the potential charges, users can weigh the cost of contacting customer support against the value of the assistance they seek.

In summary, recognizing the connection between customer support and withdrawal charges in MTN Uganda's Mobile Money services allows users to optimize their financial management. It encourages responsible use of customer support channels and promotes informed decision-making regarding paid assistance.

Frequently Asked Questions about Withdrawal Charges for MTN Uganda

This section addresses common concerns and misconceptions regarding withdrawal charges on MTN Uganda's Mobile Money platform.

Question 1: Are there any fees associated with withdrawing money from my MTN Mobile Money account?

Yes, MTN Uganda charges a withdrawal fee for each transaction. The fee varies depending on the withdrawal method used, the amount being withdrawn, and the network or bank involved.

Question 2: What is the difference between ATM, agent, and bank withdrawals?

ATM withdrawals are made through automated teller machines, while agent withdrawals are made through authorized MTN agents. Bank withdrawals involve transferring funds from your Mobile Money account to a bank account. The charges and limits for each method may vary.

Question 3: What are the withdrawal limits set by MTN Uganda?

MTN Uganda imposes both daily and monthly withdrawal limits to manage the flow of money and prevent excessive withdrawals. Exceeding these limits may result in additional charges or declined transactions.

Question 4: Can I withdraw money from my MTN Mobile Money account even if I don't have enough funds?

No, you cannot withdraw more money than what is available in your MTN Mobile Money account. Attempting to make a withdrawal without sufficient funds may result in a failed transaction and potential charges.

Question 5: What happens if I need to reverse a withdrawal transaction?

Reversing a withdrawal transaction may incur an additional fee. MTN Uganda charges a reversal fee to cover the administrative and operational costs associated with processing the reversal.

Question 6: How can I stay informed about promotional offers or discounts on withdrawal fees?

MTN Uganda occasionally offers promotions or discounts on withdrawal fees. To stay informed about these offers, you can visit the MTN Uganda website, follow their social media pages, or contact their customer care channels.

Understanding these withdrawal charges and related aspects is crucial for effective financial management and maximizing the benefits of MTN Uganda's Mobile Money services.

Transition to the next section: Explore additional insights by continuing to the next article section.

Tips Regarding Withdrawal Charges for MTN Uganda

To optimize your financial transactions and manage withdrawal charges effectively when using MTN Uganda's Mobile Money services, consider the following tips:

Tip 1: Choose the Most Cost-Effective Withdrawal Method

Understand the charges associated with different withdrawal methods, including ATM withdrawals, agent withdrawals, and bank withdrawals. Opt for the method that offers the lowest fees based on your withdrawal amount and frequency.

Tip 2: Monitor Your Withdrawal Limits

Be aware of the daily and monthly withdrawal limits set by MTN Uganda to avoid exceeding them. Exceeding the limits may result in additional charges or declined transactions.

Tip 3: Maintain Sufficient Float Balance

Ensure you have sufficient funds in your MTN Mobile Money account before initiating a withdrawal. Insufficient funds can lead to failed transactions and potential charges.

Tip 4: Utilize Promotional Offers and Discounts

Take advantage of promotional offers or discounts on withdrawal fees offered by MTN Uganda. Stay informed about these offers through their official channels to save money on your transactions.

Tip 5: Consider the Implications of Transaction Reversals

Understand that reversing a withdrawal transaction may incur an additional fee. Weigh the costs and benefits before initiating a reversal to avoid unnecessary charges.

Tip 6: Contact Customer Support Wisely

While customer support can assist with withdrawal charges or related issues, be aware that contacting customer care may incur a fee for certain services or assistance. Use these channels judiciously to avoid additional expenses.

Tip 7: Stay Informed About Changes

MTN Uganda may update its withdrawal charges or policies from time to time. Stay informed about these changes through their official communication channels to avoid any surprises or inconveniences.

By following these tips, you can effectively manage withdrawal charges, optimize your financial transactions, and make the most of MTN Uganda's Mobile Money services.

Transition to the conclusion: Explore the conclusion section for a concise summary and additional insights.

Conclusion

Understanding withdrawal charges is crucial for optimizing financial transactions using MTN Uganda's Mobile Money services. This article has explored the various aspects of withdrawal charges, including transaction fees, withdrawal methods, limits, and other related considerations.

By choosing the most cost-effective withdrawal method, monitoring withdrawal limits, maintaining sufficient float balance, and utilizing promotional offers, users can effectively manage withdrawal charges and maximize the benefits of MTN Mobile Money. Additionally, understanding the implications of transaction reversals and contacting customer support wisely can prevent unnecessary expenses.

Staying informed about changes in withdrawal charges and policies ensures that users are always up-to-date with the latest information. By following these tips and insights, individuals can make informed decisions, optimize their financial transactions, and enhance their overall experience with MTN Uganda's Mobile Money services.

Article Recommendations