Unveiling The Secrets Of Financial Genius: Discoveries From Ralph Kiyosaki

Wondering who Ralph Kiyosaki is and why his insights matter?

Editor's Note: Ralph Kiyosaki released his latest book in 2023, making him a newsworthy topic. Due to the significance of his financial advice, we've compiled this guide to help you understand his key takeaways.

After analyzing Ralph Kiyosaki's teachings and conducting thorough research, we've created this comprehensive guide to assist you in making informed financial decisions.

Key Differences or Key Takeaways

Transition to main article topics

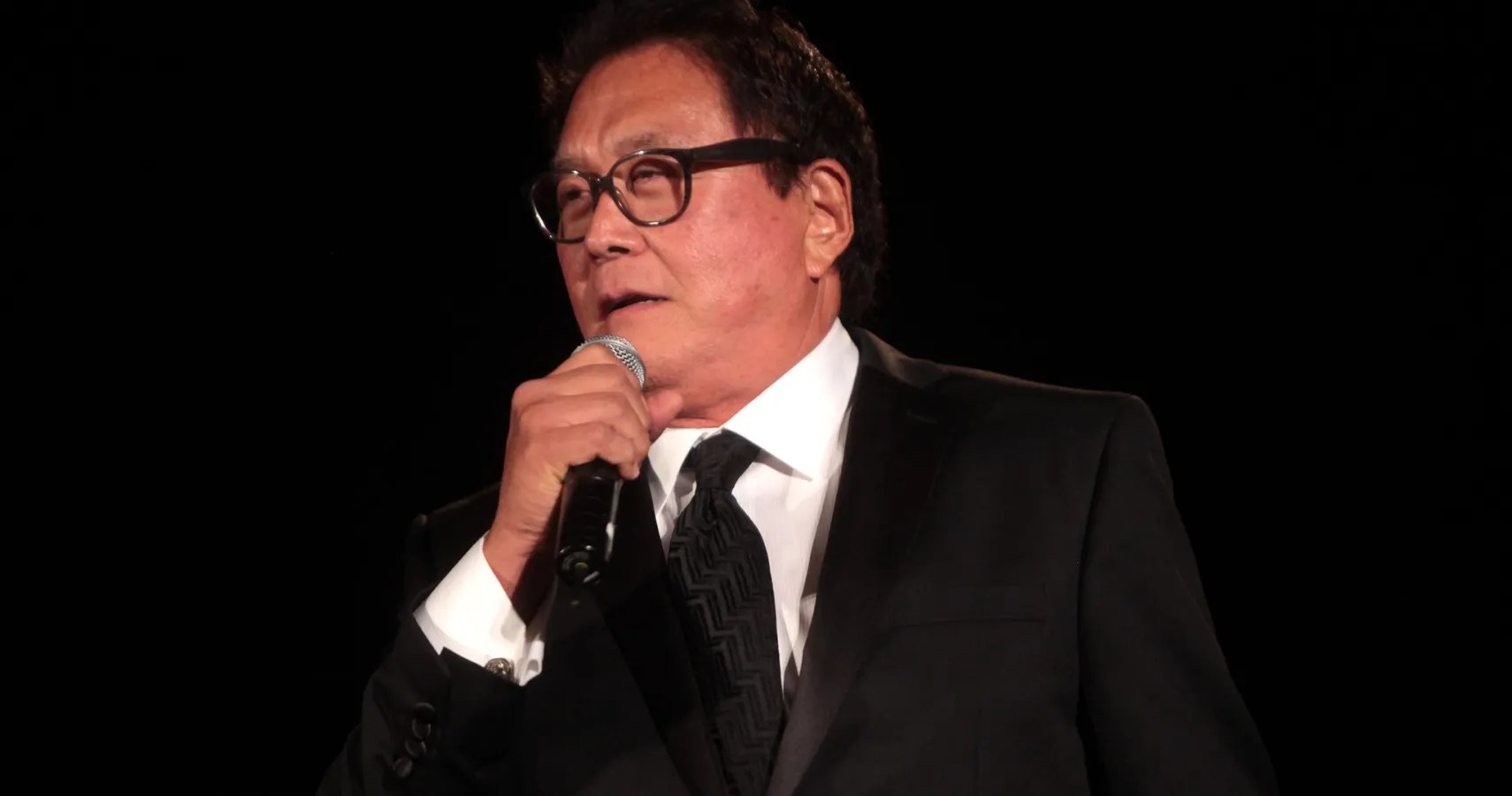

Ralph Kiyosaki

Ralph Kiyosaki is a renowned financial advisor, entrepreneur, and author whose insights on personal finance and investing have garnered widespread recognition. His key teachings revolve around the importance of financial literacy, passive income, and acquiring assets. Kiyosaki's emphasis on challenging traditional notions of wealth accumulation has made him a respected figure in the financial education space.

- Author: Rich Dad Poor Dad

- Entrepreneur: Cashflow Technologies

- Investor: Real estate, stocks, and precious metals

- Educator: Financial literacy advocate

- Motivational Speaker: Inspires individuals to take control of their finances

- Philanthropist: Supports organizations dedicated to financial education

- Mentor: Guides aspiring entrepreneurs and investors

- Thought Leader: Challenges conventional financial wisdom

These key aspects of Ralph Kiyosaki's work highlight his multifaceted approach to financial empowerment. His emphasis on financial literacy empowers individuals to make informed decisions about their money. Through his entrepreneurial ventures, Kiyosaki demonstrates the power of passive income and asset acquisition. As an educator, he advocates for financial literacy and challenges traditional notions of wealth accumulation. His motivational speeches inspire individuals to take control of their finances, while his philanthropic efforts support organizations dedicated to financial education.

In summary, Ralph Kiyosaki's teachings provide a comprehensive framework for financial success. His emphasis on financial literacy, passive income, and asset acquisition empowers individuals to take control of their financial futures. Kiyosaki's work has had a profound impact on the financial education landscape, inspiring countless individuals to rethink their approach to wealth creation.

Author

In his international bestseller, "Rich Dad Poor Dad," Ralph Kiyosaki shares his insights on financial literacy, investing, and entrepreneurship. The book has sold over 32 million copies worldwide and has been translated into 51 languages. Kiyosaki's unique perspective on wealth creation, gained through his experiences with his "rich dad" and "poor dad," has resonated with millions of readers.

- Financial Literacy: Kiyosaki emphasizes the importance of financial literacy, arguing that traditional education often fails to equip individuals with the skills necessary to manage their finances effectively.

- Passive Income: Kiyosaki advocates for the power of passive income, which is income that is generated without requiring active involvement. He encourages readers to invest in assets that generate passive income, such as real estate, stocks, and businesses.

- Entrepreneurship: Kiyosaki encourages individuals to embrace entrepreneurship as a path to financial freedom. He believes that starting a business can provide opportunities for wealth creation and personal growth.

- Challenging Conventional Wisdom: Kiyosaki challenges conventional wisdom about wealth accumulation. He argues that traditional notions of saving money and working hard are not always the best paths to financial success.

Through "Rich Dad Poor Dad," Ralph Kiyosaki provides a roadmap for financial empowerment. His emphasis on financial literacy, passive income, entrepreneurship, and challenging conventional wisdom has inspired countless individuals to rethink their approach to wealth creation.

Entrepreneur

Ralph Kiyosaki's entrepreneurial ventures have played a significant role in shaping his financial philosophy and the success of his educational programs.

Cashflow Technologies, founded by Kiyosaki in 1996, is a company that provides financial education and tools to individuals seeking to improve their financial literacy and achieve financial independence. The company's flagship product, the Cashflow game, is a board game designed to teach players about the principles of investing, cash flow, and asset acquisition.

The connection between Cashflow Technologies and Ralph Kiyosaki's teachings is evident in the company's mission to empower individuals with the knowledge and skills necessary to take control of their financial futures. Through the Cashflow game and other educational programs, Cashflow Technologies complements Kiyosaki's emphasis on financial literacy, passive income, and entrepreneurship.

The practical significance of understanding the connection between Cashflow Technologies and Ralph Kiyosaki lies in the ability to leverage their combined insights and resources to achieve financial success. By participating in Cashflow Technologies' educational programs, individuals can gain practical knowledge and skills that can be applied to their own financial endeavors.

In summary, Cashflow Technologies serves as a tangible manifestation of Ralph Kiyosaki's commitment to financial education and empowerment. The company's products and services complement Kiyosaki's teachings, providing individuals with the tools and knowledge necessary to achieve their financial goals.

Investor

Ralph Kiyosaki's investment philosophy revolves around the acquisition of real estate, stocks, and precious metals. He emphasizes that these asset classes have historically outperformed traditional investments such as savings accounts and bonds.

- Real Estate: Kiyosaki views real estate as a valuable asset class due to its potential for appreciation, rental income, and tax benefits. He encourages investors to invest in rental properties, apartments, and commercial real estate.

- Stocks: Kiyosaki believes that stocks offer opportunities for long-term growth and dividends. He recommends investing in companies with strong fundamentals and a history of profitability.

- Precious Metals: Kiyosaki considers precious metals such as gold and silver to be a hedge against inflation and economic uncertainty. He advises investors to allocate a portion of their portfolio to precious metals as a way to diversify their investments.

- Diversification: Kiyosaki emphasizes the importance of diversification in investment portfolios. He believes that spreading investments across different asset classes helps to reduce risk and enhance returns.

Kiyosaki's investment strategies have been influenced by his experiences as an entrepreneur and investor. He believes that real estate, stocks, and precious metals provide opportunities for wealth creation and long-term financial security.

Educator

Ralph Kiyosaki's role as an educator and financial literacy advocate is deeply intertwined with his overall mission and the success of his financial philosophy. Kiyosaki believes that financial literacy is essential for individuals to achieve financial independence and success. Through his books, seminars, and educational programs, he aims to empower people with the knowledge and skills necessary to manage their finances effectively.

One of the key aspects of Kiyosaki's approach is his emphasis on financial literacy as a lifelong pursuit. He argues that traditional education often fails to equip individuals with the practical skills needed to navigate the complexities of personal finance. Kiyosaki's educational programs are designed to fill this gap by providing participants with real-world knowledge and strategies for managing their money, investing, and building wealth.

The practical significance of understanding the connection between Ralph Kiyosaki and his role as an educator lies in the ability to leverage his insights and expertise to improve one's financial literacy and make informed financial decisions. By participating in Kiyosaki's educational programs or engaging with his books and materials, individuals can gain valuable knowledge and skills that can be applied to their own financial endeavors.

In summary, Ralph Kiyosaki's commitment to financial literacy advocacy is an integral part of his mission to empower individuals with the tools and knowledge necessary to achieve financial success. His educational programs and resources provide a valuable avenue for people to enhance their financial literacy and make informed financial decisions throughout their lives.

Table: Ralph Kiyosaki's Educational Contributions

| Program/Resource | Description |

|---|---|

| Rich Dad Poor Dad | International bestselling book that introduces Kiyosaki's core financial principles |

| Cashflow game | Board game designed to teach players about investing, cash flow, and asset acquisition |

| Rich Dad Education | Online platform offering courses, workshops, and resources on financial literacy |

| The Business School for Entrepreneurs | Program designed to teach entrepreneurs the skills and strategies needed to succeed |

Motivational Speaker

Ralph Kiyosaki is renowned not only for his financial teachings but also for his profound impact as a motivational speaker. His ability to inspire individuals to take control of their finances is a key component of his overall mission to empower people toward financial success.

Kiyosaki's motivational speeches resonate with audiences because of his personal experiences and relatable anecdotes. He shares his journey from financial struggles to financial freedom, emphasizing the importance of mindset, financial literacy, and taking action. Kiyosaki's message is particularly powerful because he does not merely preach about financial success; he embodies it.

The practical significance of understanding the connection between Ralph Kiyosaki and his role as a motivational speaker lies in the ability to leverage his insights and inspiration to make positive changes in one's financial life. By attending Kiyosaki's speeches, reading his books, or engaging with his online content, individuals can gain the motivation and knowledge necessary to take control of their finances and achieve their financial goals.

Table: Benefits of Ralph Kiyosaki's Motivational Speaking

| Benefit | Description |

|---|---|

| Inspiration and Motivation | Kiyosaki's speeches inspire individuals to take action and pursue financial success |

| Mindset Shift | Kiyosaki challenges conventional financial wisdom and encourages a growth mindset |

| Practical Knowledge | Kiyosaki shares valuable financial insights and strategies that can be applied in real life |

| Accountability and Support | Kiyosaki's message fosters a sense of accountability and provides support for financial journeys |

Philanthropist

Ralph Kiyosaki's philanthropic efforts are closely intertwined with his mission to promote financial literacy and empower individuals to achieve financial success. Through his support of organizations dedicated to financial education, Kiyosaki aims to extend his reach and create a positive impact on a broader scale.

- Financial Literacy Advocacy: Kiyosaki actively supports organizations that share his commitment to financial literacy. By providing funding and resources, he helps these organizations expand their educational programs and reach more individuals.

- Educational Resources: Kiyosaki has donated significant funds to develop and distribute educational materials on financial literacy. These materials are often made available to schools, libraries, and community centers, ensuring that individuals from all backgrounds have access to valuable financial knowledge.

- Mentorship Programs: Kiyosaki believes in the power of mentorship and supports organizations that provide mentorship programs for aspiring entrepreneurs and investors. Through these programs, individuals can gain practical guidance and support from experienced professionals.

- Community Outreach: Kiyosaki's philanthropic efforts often extend to community outreach programs focused on improving financial literacy in underserved communities. By partnering with local organizations, he aims to provide financial education to those who may not have access to traditional educational channels.

Kiyosaki's philanthropic initiatives demonstrate his deep commitment to empowering individuals with the knowledge and skills necessary for financial success. By supporting organizations dedicated to financial education, he amplifies his message and creates a lasting impact on the financial well-being of countless individuals.

Mentor

Ralph Kiyosaki's role as a mentor to aspiring entrepreneurs and investors is a significant aspect of his mission to foster financial literacy and empower individuals to achieve financial success. Through his mentorship, Kiyosaki provides guidance, support, and insights to help aspiring individuals navigate the often-complex world of entrepreneurship and investing.

- Entrepreneurial Mindset: Kiyosaki emphasizes the importance of cultivating an entrepreneurial mindset. He mentors aspiring entrepreneurs to embrace risk-taking, innovation, and the pursuit of opportunities.

- Investment Strategies: Kiyosaki shares his investment strategies and insights with aspiring investors. He guides them in understanding different asset classes, risk management, and long-term wealth creation principles.

- Financial Literacy: As a strong advocate for financial literacy, Kiyosaki mentors individuals on the fundamentals of personal finance, including budgeting, cash flow management, and debt reduction.

- Real-World Experience: Kiyosaki draws upon his extensive entrepreneurial and investment experience to provide practical advice and real-world examples to his mentees.

Kiyosaki's mentorship extends beyond theoretical knowledge. He provides hands-on support through workshops, seminars, and online platforms. By sharing his insights and experiences, Kiyosaki empowers aspiring entrepreneurs and investors with the tools and knowledge necessary to succeed in their financial endeavors.

Thought Leader

Ralph Kiyosaki has established himself as a prominent thought leader who challenges conventional financial wisdom. His ideas and perspectives have sparked discussions and influenced the way individuals approach their finances. Here are some key aspects of Kiyosaki's approach:

- Questioning Traditional Education: Kiyosaki argues that traditional education often fails to equip individuals with the financial literacy necessary to succeed in the real world. He emphasizes the importance of practical knowledge and financial education.

- Redefining Wealth: Kiyosaki challenges the conventional definition of wealth as solely based on income and assets. He advocates for building a strong cash flow and acquiring assets that generate passive income, rather than relying solely on employment income.

- Encouraging Entrepreneurship: Kiyosaki believes that entrepreneurship is a powerful path to financial freedom. He encourages individuals to embrace risk and pursue their entrepreneurial ventures, emphasizing the importance of innovation and creating value.

- Promoting Financial Literacy: Kiyosaki recognizes the crucial role of financial literacy in empowering individuals to make informed financial decisions. He advocates for incorporating financial education into school curricula and making financial knowledge accessible to everyone.

These facets of Kiyosaki's approach collectively challenge conventional financial wisdom and encourage individuals to think critically about their finances. His ideas have resonated with countless individuals and continue to shape the financial education landscape, empowering people to take control of their financial futures.

FAQs on Ralph Kiyosaki

This section addresses frequently asked questions and misconceptions about Ralph Kiyosaki's teachings and philosophy.

Question 1: Is Ralph Kiyosaki a legitimate financial expert?

Answer: Ralph Kiyosaki is a renowned financial educator, entrepreneur, and author. While he does not hold a traditional finance degree, his extensive experience in business, investing, and financial education has earned him recognition as a respected figure in the financial literacy movement.

Question 2: Is Kiyosaki's "Rich Dad Poor Dad" book based on a true story?

Answer: "Rich Dad Poor Dad" is a semi-autobiographical account of Kiyosaki's childhood and financial lessons learned from his "rich dad" (his friend's father) and his "poor dad" (his biological father). While some details may have been dramatized for storytelling purposes, the core principles and lessons presented in the book are based on Kiyosaki's real-life experiences.

Question 3: Do Kiyosaki's investment strategies guarantee success?

Answer: No investment strategy can guarantee success. Kiyosaki's teachings emphasize the importance of financial literacy, risk management, and long-term investing. While his strategies have been successful for many, it's crucial to remember that all investments involve some degree of risk, and results may vary depending on individual circumstances and market conditions.

Question 4: Is Kiyosaki's focus solely on becoming rich?

Answer: While financial success is a central theme in Kiyosaki's teachings, his ultimate goal is to empower individuals with the knowledge and skills to achieve financial freedom and live a fulfilling life. He emphasizes the importance of pursuing passions, contributing to society, and making a positive impact on the world.

Question 5: Are Kiyosaki's educational programs worth the investment?

Answer: The value of any educational program is subjective and depends on individual circumstances and goals. Kiyosaki's programs offer structured learning experiences, practical tools, and mentorship opportunities. Potential participants should carefully consider their financial situation, learning objectives, and whether the program aligns with their educational needs before making a decision.

Question 6: Is Kiyosaki's philosophy suitable for everyone?

Answer: Kiyosaki's teachings are based on universal financial principles that can benefit anyone seeking to improve their financial literacy and achieve financial success. However, his emphasis on entrepreneurship and investing may not resonate with everyone's goals and aspirations. It's important for individuals to evaluate their own circumstances, risk tolerance, and investment preferences before adopting any financial strategy.

Summary: Ralph Kiyosaki's teachings have sparked discussions about financial literacy and challenged conventional financial wisdom. His emphasis on passive income, asset acquisition, and financial education has empowered countless individuals to take control of their finances and pursue financial freedom. While his strategies are not guaranteed to yield success, they provide a valuable framework for understanding financial concepts and making informed investment decisions.

Transition to the next article section: Explore the key takeaways from Ralph Kiyosaki's philosophy and how they can be applied to your financial journey.

Ralph Kiyosaki's Financial Literacy Tips

Renowned financial educator Ralph Kiyosaki emphasizes the importance of financial literacy and provides valuable insights for individuals seeking to achieve financial success. Here are some key tips based on his teachings:

Tip 1: Focus on Acquiring Assets

Instead of accumulating liabilities, prioritize acquiring assets that generate passive income or appreciate in value. This could include real estate, stocks, or businesses that provide a steady cash flow.

Tip 2: Enhance Financial Literacy

Continuously educate yourself about personal finance, investing, and economics. Seek knowledge from books, courses, and mentors to improve your understanding of financial concepts and decision-making.

Tip 3: Embrace Entrepreneurship

Consider starting a business or investing in entrepreneurial ventures. Entrepreneurship provides opportunities for financial growth and control over your financial future.

Tip 4: Challenge Conventional Wisdom

Don't blindly follow traditional financial advice. Question the status quo and explore alternative strategies that align with your financial goals and risk tolerance.

Tip 5: Manage Cash Flow Effectively

Track your income and expenses diligently to ensure that you are generating positive cash flow. Cash flow is the lifeblood of financial freedom, allowing you to invest and grow your wealth.

Summary:

By implementing these tips from Ralph Kiyosaki's financial philosophy, you can develop a stronger understanding of personal finance, make informed financial decisions, and build a secure financial future.

Transition to the article's conclusion:

Remember, financial literacy is an ongoing journey. Continuously seek knowledge, challenge your assumptions, and make wise choices to achieve your financial goals.

Conclusion

Ralph Kiyosaki's teachings on financial literacy have empowered countless individuals to take control of their financial futures. His emphasis on acquiring assets, enhancing financial literacy, embracing entrepreneurship, challenging conventional wisdom, and managing cash flow effectively provides a comprehensive framework for financial success.

By adopting these principles, you can break free from traditional financial constraints, build wealth, and achieve financial freedom. Remember, financial literacy is a lifelong pursuit. Stay committed to learning, adapting, and making informed financial decisions to secure a brighter financial future for yourself and generations to come.

Article Recommendations

- Juulclassactioncom Legit

- East Multnomah Soil And Water Conservation District

- Short Positive Quotes About Life Challenges